2018 Retirement Legislation – Final Update

By: Jim Linn and Glenn Thomas

The 2018 Legislative Session was scheduled to adjourn on March 9th, but the House and Senate couldn’t finalize a budget deal until March 8th. Because the Florida Constitution requires a 72-hour “cooling off” period before the budget can be passed, the session was extended, and officially ended on March 11th. Very few retirement bills passed. The session ended with most retirement legislation making no significant progress. The bills that passed, including the 2018-19 Florida Retirement System employer contribution rates, are summarized below, along with a description of the retirement legislation that did not pass this year.

Copies of any bill can be viewed at the legislature’s website: www.leg.state.fl.us. Please feel free to contact us if you have any questions.

Bills That Passed

HB 5007 FRS Employer Contribution Rates

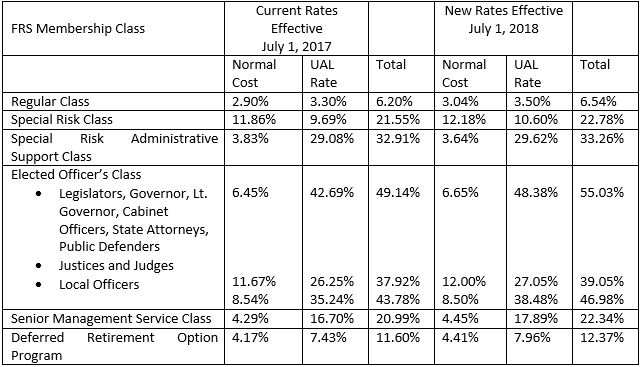

HB 5007 contains the FRS employer contribution rates for the year beginning July 1, 2018. The contribution rates are intended to fund the full normal cost as well as the amortization payment for unfunded actuarial liabilities, as reflected in the actuarial valuation for fiscal year ended June 30, 2017. The bill provides the following employer contribution rates:

FRS Employer Contribution Rates for 2017 and 2018

Note: the above employer contribution rates do not include the FRS health insurance subsidy contribution (1.66%), which is not changed in the bill; or the 0.06% employer assessment for administrative and educational expenses. Also, the above employer contribution rates do not reflect the 3% member contribution.

HB 5007 was signed by Governor Scott on March 16th (Chapter No. 2018-12, Laws of Florida) and will take effect on July 1, 2018.

CS/SB 376 (Book) / CS/CS/HB 227 (Willhite, Plasencia) Workers’ Compensation Benefits for First Responders

In the closing days of the 2018 session, CS/CS/HB 227 was replaced by CS/CS/376, which passed both houses. These bills were among several filed in response to complaints concerning inadequate workers’ compensation benefits for first responders in the wake of the June 2016 Pulse nightclub shooting, in which 49 people were killed and at least 68 others injured. First responders who are being treated for post-traumatic stress disorder (PTSD) following the incident learned that they were not eligible for workers’ compensation benefits because under current law workers’ compensation compensability for a mental or nervous injury has to be accompanied by a physical injury, which the employees did not have.

Under current law, a mental or nervous injury due to stress, fright, or excitement without an accompanying physical injury requiring medical treatment is not considered an injury “by accident arising out of the employment” under the workers’ compensation law, and payment of indemnity benefits is not allowed for such injuries. Further, any compensable mental or nervous injury (one accompanied by a physical injury) must be demonstrated by clear and convincing medical evidence by a licensed psychiatrist. The compensable physical injury as determined by reasonable medical certainty must be at least 50 percent responsible for the mental or nervous condition.

CS/CS/SB 376 amends section 112.1815, Florida Statutes (relating to job-related injuries of firefighters, paramedics, emergency medical technicians, and law enforcement officers), effective October 1, 2018, to revise standards for determining whether a mental or nervous injury is compensable under workers’ compensation as an injury arising out of employment. Most importantly, the provision of law barring workers’ compensation indemnity benefits for employment-related mental or nervous injury unaccompanied by a physical injury has been removed under certain circumstances.

The new law creates an exception to the current prohibition on the payment of indemnity benefits for a mental or nervous injury without a physical injury, if certain conditions are met. PTSD for a first responder will now be deemed a “compensable occupational disease” as defined under section 440.151(4), Florida Statutes, if it resulted from the first responder acting within the course of his or her employment as a result of one of the following events:

- Seeing for oneself a deceased minor;

- Directly witnessing the death of a minor;

- Directly witnessing an injury to a minor who subsequently died before or upon arrival at a hospital emergency department;

- Participating in the physical treatment of an injured minor who subsequently died before or upon arrival at a hospital emergency department;

- Manually transporting an injured minor who subsequently died before or upon arrival at a hospital emergency department;

- Seeing for oneself a decedent whose death involved grievous bodily harm of a nature that shocks the conscience;

- Directly witnessing a death, including suicide, that involved grievous bodily harm of a nature that shocks the conscience;

- Directly witnessing a homicide regardless of whether the homicide was criminal or excusable, including murder, mass killing as defined in 28 U.S.C. s. 530C, manslaughter, self-defense, misadventure, and negligence;

- Directly witnessing an injury, including an attempted suicide, to a person who subsequently died before or upon arrival at a hospital emergency department if the person was injured by grievous bodily harm of a nature that shocks the conscience;

- Participating in the physical treatment of an injury, including an attempted suicide, to a person who subsequently died before or upon arrival at a hospital emergency department if the person was injured by grievous bodily harm of a nature that shocks the conscience; or

- Manually transporting a person who was injured, including by attempted suicide, and subsequently died before or upon arrival at a hospital emergency department if the person was injured by grievous bodily harm of a nature that shocks the conscience.

“First responders” include volunteers or employees in the position of law enforcement officer, firefighter, EMT or paramedic. “Directly witnessing” is defined as seeing and hearing for oneself, and “manually transporting” means to physically move the body of a wounded person.

The first responder must be examined and diagnosed by a licensed psychiatrist who is an authorized treating physician as defined under chapter 440. While earlier versions of the bill sought to lower the evidentiary standard for demonstrating PTSD injuries under section 112.1815, from “clear and convincing” to “a preponderance of the evidence,” the final bill requires that PTSD be demonstrated by clear and convincing evidence.

Neither medical nor indemnity workers’ compensation benefits for PTSD will be subject to apportionment due to a preexisting diagnosis of PTSD. Those benefits are also not subject to any limitation on temporary benefits under section 440.093 or the 1% limitation on permanent psychiatric impairment benefits under section 440.15(3).

The first responder must file the notice of injury with their employer or carrier within 90 days of the qualifying event or manifestation of the PTSD. However, in no event may a claim be filed later than 52 weeks following the qualifying event. The new law requires employers to provide educational training related to mental health awareness, prevention, mitigation, and treatment.

Although the new law does not directly amend Chapters 175 and 185 (the laws governing most local police and firefighter pension plans), there may still be an effect on police and firefighter pension plans in Florida. To the extent that an employee’s workers’ compensation records are considered in determining eligibility for in-line-of-duty disability benefits under a local police or firefighter pension plan, the law will likely result in higher incidence of disability pension benefit awards. Until the completion of an actuarial review it is impossible to estimate the impact of CS/CS/SB 376 on local plans; but when there is the potential for a higher incidence of in-line-of-duty disability benefit awards, increased plan costs are likely.

CS/CS/SB 376 was signed by Governor Scott on March 27th (Ch. 2018-124, Laws of Florida), and will take effect October 1, 2018.

HB 359 (Nunez, Diaz) FRS Investments

The State Board of Administration (SBA) has the responsibility for oversight of FRS Pension Plan investments and the FRS Investment Plan. Under HB 359, effective July 1, 2018, the SBA is required to divest of any investments and would be prohibited from investing in stocks, securities, or other obligations of any institution or company domiciled in the United States doing business in or with the government of Venezuela, or with any agency or instrumentality thereof, in violation of federal law. The term “government of Venezuela” means the government of Venezuela, its agencies or instrumentalities, or any company that is majority-owned or controlled by the government of Venezuela. The Governor can waive the divestment requirements if the existing regime in Venezuela collapses and there is a need for immediate aid to Venezuela before the convening of the Legislature or for other humanitarian reasons as determined by the Governor.

HB 359 was signed by the Governor on March 29th, and takes effect on July 1, 2018.

CS/HB 495 (Diaz; Bileca) K-12 Public Education

The provisions of CS/SB 1240 (Mayfield), HB 977 (Fine) and CS/CS/HB 323 (Education), which related to the FRS Deferred Retirement Option Plan (DROP) for teachers and administrative personnel were included in an amendment to the education bill (HB 495), which passed. Under current law, FRS members may participate in DROP for a maximum of 60 calendar months. However, if allowed by their District, teachers may extend the DROP period for an additional 36 months. Under CS/HB 495, effective July 1, 2018, teachers who are authorized to extend their DROP period will be required to have a termination date that is the last day of the last calendar month of the school year within the extended DROP period. The bill also authorizes administrative personnel in grades k-12 to extend their DROP period beyond the 60-month period if their termination date occurs prior to the end of the school year.

HB 495 was presented to the Governor on March 26, 2018. He has 15 days to take action on the bill.

Bills That did not Pass

HB 251 (Clemons) SB 406 (Steube) FRS – Reemployment After Retirement

Under current law, an FRS member whose retirement is effective before July 1, 2010, or whose participation in the Deferred Retirement Option Program terminates before July 1, 2010, may be reemployed by an FRS employer if the reemployment occurs at least one calendar month after retirement. However, the member may not receive both a salary and retirement benefits for 12 months after retirement. If a member is reemployed while receiving retirement benefits the member must notify the employer and FRS, and benefits are suspended until the 12-month period concludes. Under HB 251, a member could have been reemployed by an employer participating in the FRS before completion of the 12-month limitation period if the retiree was employed on a part-time basis and was not qualified to receive retirement benefits during the 12-month period after the date of reemployment.

HB 379 (Willhite, Gonzalez) / SB 606 (Steube) Florida Retirement System – Special Risk Class

This bill would have permitted any FRS member employed as a 911 public safety telecommunicator to participate in the Special Risk class of the Florida Retirement System. This means telecommunicators would have been able to retire earlier (at age 60 with 8 years of service or 30 years of service regardless of age, if initially enrolled in FRS on or after July 1, 2011; or at age 55 with 8 years of service or with 25 years of service regardless of age, if initially enrolled in FRS before July 1, 2011). However, monthly benefits for 911 telecommunicator members would still have been calculated using the Regular Class multiplier (1.6%).

HB 493 (Diaz, M.) / SB 1758 (Montford) Florida Retirement System – Special Risk Class

HB 493 would have extended membership in the FRS Special Risk Class to Florida State Hospital employees who spend at least 65 percent of his or her time performing duties that involve contact with patients or inmates. Benefits would have been calculated using the Special Risk Multiplier (3.0%).

HB 615 (Raschein) / SB 1778 (Flores) Florida Retirement System – Special Risk Class

This bill would have added to the Special Risk Class members who are employed by a local government as a pilot or registered nurse and whose primary duties and responsibilities are performed on an air ambulance service. Benefits would have been calculated using the Special Risk Multiplier (3.0%).

SB 1518 (Rodriguez) Florida Retirement System – Special Risk Class

This bill would have added water, sewer and other public works employees who work in hazardous conditions, as well as police service aides, to the FRS Special Risk class.

HB 695 (Fitzenhagen) / CS/CS/SB 900 (Flores) Cancer Benefits for Firefighters

HB 695 and CS/SB 900 would have created a new section 112.1816, Florida Statutes, to provide benefits for firefighters diagnosed with cancer. Under this section, upon a diagnosis of cancer, a firefighter would have been entitled, at no cost, to an insurance policy that provides cancer treatment using the same health care network as the policy provided to all other employees of the employer for at least 10 years after the firefighter leaves employment, and a cash payout of $25,000. To be eligible the firefighter must have been employed by his or her employer for at least 5 continuous years, not used tobacco products for the preceding 5 years, and not been employed in any other position in the preceding 5 years which is proven to create a higher risk for any cancer.

The bill would have also required an employer to consider any cancer diagnosis of a firefighter to be an injury or illness incurred in the line of duty.

Governmental retirement plans would have been required to consider a firefighter totally and permanently disabled if he or she is prevented from rendering useful and effective service as a firefighter and is likely to remain disabled continuously and permanently due to the diagnosis of cancer or circumstances arising out of cancer treatment. If the firefighter did not participate in a retirement plan, the employer would have been required to provide a disability retirement plan that pays the firefighter at least 42 percent of annual salary until the firefighter’s death in the event of a disability attributable to a diagnosis of cancer or disabilities arising out of cancer treatment.

If a firefighter dies as a result of cancer or circumstances arising out of cancer treatment, an employer sponsored retirement plan would have been required to consider the death as occurring in the line of duty. If the deceased firefighter did not participate in a retirement plan, the employer would have been required to provide a death benefit to the firefighter’s beneficiary equal to 42 percent of the firefighter’s annual salary for 10 years following the firefighter’s death.

The beneficiary of a firefighter who dies as a result of cancer or circumstances arising out of cancer treatment would have been eligible for benefits under section 112.191(2)(a), which provides a $50,000, death benefit when a firefighter is accidentally killed or receives accidental bodily injury which subsequently results in the loss of the firefighter’s life, while engaged in the performance of his or her firefighter duties.

The bills would have required the costs of any insurance policy providing benefits in the new section, or the costs of a self-funded system, to be paid entirely by the employer.

These bills were significantly different from firefighter cancer bills filed in 2017. The 2017 bills would have created a rebuttable presumption that a firefighter’s death or disability due to certain forms of cancer was accidental and suffered in the line of duty unless proven otherwise by competent evidence. The firefighter would have also been required to successfully pass a physical examination that failed to reveal evidence of cancer. Under these bills, all cancer, regardless of the type or cause, resulting in a disability would have been deemed to have occurred in the line of duty. There would have been no mechanism to rebut this conclusion.

Late amendments to SB 900 corrected some of the bill’s issues. A committee substitute (CS) adopted by the Senate Governmental Oversight and Accountability Committee revised the benefits to which firefighters would be entitled upon a diagnosis of cancer to provide that the benefits are an alternative to pursuing workers’ compensation benefits. It also amended the entitlement benefit from a group health insurance or self-insurance policy to the benefit of cancer treatment that is covered within an employer-sponsored health plan or through a group health insurance trust fund.

The CS would have allowed an employer to reimburse a firefighter for out-of-pocket deductible, copayment or coinsurance costs incurred by the firefighter for treatment. It also clarified that the cash payout of $25,000 was a one-time payment. It limited the applicability of the bill’s requirement that a cancer diagnosis be considered a line-of-duty illness or injury, to determining leave time and employee retention policies. This means that a diagnosis of cancer is not required to be considered a line-of-duty illness or injury for any other purposes, such as the provision of other benefits.

Under a subsequent CS adopted by the Senate Community Affairs Committee, the term “cancer” would have been limited to bladder cancer, brain cancer, breast cancer, cervical cancer, colon cancer, esophageal cancer, kidney cancer, large intestinal cancer, lung cancer, malignant melanoma, mesothelioma, multiple myeloma, non-Hodgkin’s lymphoma, oral cavity and pharynx cancer, ovarian cancer, prostate cancer, rectal cancer, skin cancer, stomach cancer, testicular cancer, and thyroid cancer.

SB 722 (Garcia) / HB 665 (Clemons) Florida Retirement System – COLA

SB 722 provided for a cost-of-living adjustment (COLA) of at least 2% for FRS members who retire on or after July 1, 2011 with service credit earned prior to July 1, 2011. Under the current FRS statute, a 3% COLA is applied to benefits earned before July 1, 2011, but no COLA is applied to benefits earned on or after that date. Thus, the member’s COLA amount is based on the quotient of the member’s service credit earned before July 1, 2011, divided by the member’s total service credit. Under SB 722, the COLA for members with FRS service before July 1, 2011 could not be less than 2%.

SB 980 (Brandes) / HB 1363 (McClure) Publicly Funded Retirement Programs

These bills contained several changes to Chapters 112 and 121, affecting government retirement plan funding, and would have resulted in significant changes to actuarial assumptions used by plan actuaries in determining employer contributions.

Part VII of Chapter 112, Florida Statutes, created the “Florida Protection of Public Employee Retirement Benefits Act,” which is intended to implement the actuarial funding provisions of s. 14, Art. X of the State Constitution related to governmental retirement plans in Florida. The Act states that governmental retirement systems must be managed, administered, operated, and funded in a manner that maximizes the protection of benefits and it prohibits the use of any procedure, methodology, or assumptions that transfer to future taxpayers any portion of pension costs which may reasonably be paid by the current taxpayers. The Act also establishes minimum standards for the operation and funding of government retirement systems in Florida, including the standards for actuarial reports. SB 980 would have revised several of those actuarial standards.

Actuarial Reports

Under current law, governmental retirement plans are required to have regularly scheduled actuarial reports (at least once every three years) prepared and certified by an enrolled actuary, which must include, at a minimum,

- The adequacy of contribution rates in meeting levels of employee benefits provided in the system and changes, if any, needed in such rates to achieve or preserve a level of funding deemed adequate to enable payment through the indefinite future of the benefit amounts prescribed by the system, which shall include a valuation of present assets, based on statement value, and prospective assets and liabilities of the system and the extent of unfunded accrued liabilities, if any.

- A plan to amortize any unfunded liability pursuant to s. 112.64 and a description of actions taken to reduce the unfunded liability.

- A description and explanation of actuarial assumptions.

- A schedule illustrating the amortization of unfunded liabilities, if any.

- A comparative review illustrating the actual salary increases granted and the rate of investment return realized over the 3-year period preceding the actuarial report with the assumptions used in both the preceding and current actuarial reports.

- The mortality tables used in either of the two most recently published actuarial valuation reports of the Florida Retirement System, including the projection scale for mortality improvement. Appropriate risk and dollar adjustments must be made based on plan demographics. The tables must be used for assumptions for preretirement and postretirement mortality.

- A statement by the enrolled actuary that the report is complete and accurate and that in his or her opinion the techniques and assumptions used are reasonable and meet the requirements and intent of this act.

Under SB 980 actuarial reports would have been required to include a list of preretirement and postretirement benefits provided to employees, including, but not limited to, life insurance; health insurance; dental care; vision care; fitness programs, discounts, or reimbursements; continuing education or tuition credit programs; cost-of-living adjustments; payment for unused leave; disability insurance; and health savings accounts or flexible spending accounts.

Plan Assumptions Analysis

Under SB 980, the statement by the plan actuary that the report is complete and accurate, would have included an analysis of the assumed rate of return established by the plan’s governing body (i.e. the pension board). This analysis would contain specific recommendations by the actuary regarding an appropriate assumed rate of return. The board would be required to review the statement of the actuary within 30 days and if it adopted assumptions that differed from those recommended by the actuary the board must explain in writing to the Department of Management Services why the recommended actuarial assumptions were not adopted.

Amortization of Unfunded Liability

Under current law, governmental plans established after October 1, 1980 are required to amortize any unfunded liability over a period of no more than 40 years. SB 980 would have required plans coming into existence after October 1, 2018 to amortize the unfunded liability within 30 years.

Payroll Growth Assumption

Current law prohibits actuarial assumption as to payroll growth from exceeding the employer’s average payroll growth for the 10 years preceding the latest actuarial valuation of the plan. SB 980 would have limited the payroll growth assumption to the average growth over the preceding 3 years.

The bills would have eliminated the ability of plans to continue using the same payroll growth assumption in their unfunded liability amortization schedule regardless of the 10 year payroll growth rate. Current law permits the practice if the assumptions underlying the payroll growth rate are consistent with the actuarial assumptions used to determine the unfunded liabilities, and the payroll growth rate is reasonable and consistent with future expectations of payroll growth.

Additional Reporting Requirements

Under current law, governmental plans are required to maintain certain information on plan members, including:

- For active members: A means of identification; date of birth; sex; date of employment; period of credited service, split, if required, between prior service and current service; and occupational classification.

- For active members: Cumulative contributions together with accumulated interest, if credited, age at entry into system, and current rate of contribution.

- For inactive members: average final compensation and age at which deferred benefit is to begin.

- For retired members: a means of identification, date of birth, sex, beginning date of benefit, type of retirement and amount of monthly benefit, and type of survivor benefit.

SB 980 would have required governmental plans to not only maintain the above information, but to report it to the Department of Management Services along with the plan’s actuarial report.

Plans are currently required, within 60 days of receipt of the actuarial report, to report the recommended employer contribution expressed as a dollar amount and as a percentage of payroll. SB 980 would have required the recommended employer contribution to also be expressed as a percentage of the employer’s annual revenue.

SB 980 would have required the Department of Management Services to publish all of the data on governmental retirement plans it receives. Currently, the information is collected and subject to disclosure under public records laws; but the data is not published by the Department.

FRS Actuarial Study

Under section 121.031, an actuarial study of FRS must be performed every year and the results reported to the legislature before the beginning of the legislative session. SB 980 would have required the results of the report to be reported to the Governor, the President of the Senate, and the Speaker of the House by December 31 before the next regular legislative session.

Among the consensus estimating conferences required under section 216.136(10), is the Florida Retirement System Actuarial Assumption Conference. The principals of the conference include Executive Office professional staff, the coordinator of the Office of Economic and Demographic Research, professional staff of the Senate and professional staff of the House of Representatives. The FRS Actuarial Assumption Conference is required to prepare an analysis of the actuarial assumptions and methods used in the FRS actuarial study and to determine whether changes to the assumptions or methods are required. SB 980 would have required the FRS actuarial study to include this analysis by the Conference along with specific recommendations regarding an appropriate assumed rate of return.

Section 121.0312 requires the Governor, Chief Financial Officer, and Attorney General, sitting as the Board of Trustees of the State Board of Administration, to review the FRS actuarial valuation report. In addition to this review, SB 980 would have required the Governor, the President of the Senate, and the Speaker of the House, within 30 days of receipt, to acknowledge in writing their acceptance and review of the report, and any recommendations in the report regarding actuarial assumptions. The review would contain an explanation from each principal as to why actuarial assumptions other than those recommended by the actuary were adopted by the Florida Retirement System Actuarial Assumption Conference. The Department of Management Services would then publish the written acknowledgments as addenda to the actuarial valuation report.

HB 1209 (Asencio) / SB 1692 (Torres) FRS Normal Retirement Date

These bills would have restored the FRS normal retirement date for regular and special risk class members hired on and after July 1, 2011, to the normal retirement date for members hired before that date. Regular class members would be able to retire at age 62 with eight years of service, or with 30 years of service regardless of age. Special risk members would be able to retire at age 55 with eight years of service, or with 25 years of service regardless of age. The bills also made conforming changes to FRS early retirement and DROP provisions.

If you have any questions on a bill, please let us know.