2019 Retirement Legislation – First Week of Session Report

By: Jim Linn and Glenn E. Thomas

The 2019 regular session of the Florida Legislature convened on March 5, 2019, and is scheduled to adjourn on May 3, 2019. Several local government and FRS retirement bills have been filed. The one bill that appears to be moving is SB 426, providing cancer benefits for firefighters. A summary of the bills follows.

Copies of any bill can be viewed at the legislature’s website: www.leg.state.fl.us. Please feel free to contact us if you have any questions.

SB 402 FRS Reemployment of School Personnel (Gruters); HB 137 (Good)

SB 402 would allow teachers who retired under the Florida Retirement System to be reemployed as substitute teachers within 6 months of retirement or deferred retirement option plan participation (DROP). The reemployed substitute teachers would not renew membership or receive additional service credit under FRS. The bill requires the Department of Management Services to obtain a Private Letter Ruling (PLR) from the Internal Revenue Service to confirm that the legislation does not violate the requirements for qualification under section 401(a) of the Internal Revenue Code.

SB 402 has been referred to Education; Governmental Oversight and Accountability; and Appropriations Committees. HB 137 has been referred to Oversight, Transparency & Public Management Subcommittee; Appropriations Committee; and State Affairs Committee.

SB 426 Firefighter Cancer (Flores); HB 857 (Willhite)

SB 426 and HB 857 create a new section 112.1816, entitled “Firefighters; cancer diagnosis.” Upon a diagnosis of cancer, a firefighter is entitled to the following benefits, as an alternative to pursuing workers’ compensation benefits:

- Cancer treatment, covered by an employer health plan at no cost to the firefighter

- A one-time cash payout of $25,000 upon initial diagnosis

These benefits must be available for 10 years following the date the firefighter terminates employment, unless the firefighter is reemployed by any employer as a firefighter.

To be eligible for the benefits, the firefighter must have been with the same employer for 5 continuous years, not used tobacco products for the last 5 years, and not been employed in another position with a higher risk of cancer in the last five years.

For purposes of determining leave time and employee retention policies, the employer must consider a firefighter’s cancer diagnosis as an injury or illness incurred in the line of duty.

Firefighter retirement plans must consider a firefighter totally and permanently disabled if he or she is prevented from rendering useful and effective service as a firefighter and is likely to remain disabled continuously and permanently due to the diagnosis of cancer or circumstances that arise out of the treatment of cancer. Similarly, if a firefighter dies as a result of cancer or circumstances that arise out of the treatment of cancer, the plan must consider the firefighter to have died in the line of duty.

If there is no retirement plan, the employer must provide a disability retirement plan that provides the firefighter with at least 42% of his or her annual salary, at no cost to the firefighter, until the firefighter’s death, for total and permanent disabilities attributable to the diagnosis of cancer which arise out of the treatment of cancer. The employer must also provide a death benefit to the firefighter’s beneficiary, at no cost to the firefighter or his or her beneficiary, totaling at least 42% of the firefighter’s most recent annual salary for at least 10 years following the firefighter’s death.

Firefighters who die as a result of cancer or circumstances that arise out of the treatment of cancer are considered to have died in the manner described in section 112.191(2)(a)[death while performing duties], which provides a $50,000 one-time payment to the firefighter’s beneficiary.

The Division of State Fire Marshal within the Department of Financial Services must adopt rules to establish employer cancer prevention best practices as it relates to personal protective equipment, decontamination, fire suppression apparatus, and fire stations.

SB 426 has passed the Senate Governmental Oversight and Community Affairs Committees, and will be considered next by the Senate Appropriations Committee. HB 857 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee.

SB 784 FRS Cost of Living Adjustment (Gruters); HB 779 (Clemons, Willhite)

These bills would provide a minimum cost-of-living adjustment (COLA) of at least 2% for FRS members who retire on or after July 1, 2011 with service credit earned prior to July 1, 2011. Under the current FRS statute, a 3% COLA is applied to benefits earned before July 1, 2011, but no COLA is applied to benefits earned on or after that date. Thus, the member’s COLA amount is based on the quotient of the member’s service credit earned before July 1, 2011, divided by the member’s total service credit. Under SB 784, the COLA for members with FRS service before July 1, 2011 could not be less than 2%.

SB 784 has been referred to the Senate Governmental Oversight and Accountability Committee; Appropriations Subcommittee on Agriculture, Environment, and General Government; and Appropriations Committee. HB 779 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee

HB 1091 Pension of Retired Deputy Scot Peterson (Roach); SB 1450 (Gruters)

These bills declare that Deputy Scot Peterson, who recently retired from the Broward County Sheriff’s Office, shall forfeit all rights & benefits under the Florida Retirement System due to “his wanton or willful neglect in performance of his assigned duties & contravention of his oath of office.” in connection with his response to the 2018 mass shooting incident at Marjory Stoneman Douglas High School. HB 1091 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee. SB 1450 has been referred to the Senate Governmental Oversight and Accountability; Judiciary; and Appropriations Committees.

SB 1096 FRS Reemployment after Retirement (Perry); HB 631 (Watson)

Under current law, an FRS member who retired or ended DROP participation before July 1, 2010 may be reemployed by an FRS employer if the reemployment occurs at least one calendar month after retirement. However, the member may not receive both a salary and retirement benefits for 12 months after retirement. If a member is reemployed while receiving retirement benefits the member must notify the employer and FRS, and benefits are suspended until the 12-month period concludes. Under SB 1096, a member could have been reemployed by an employer participating in the FRS before completion of the 12-month limitation period if the retiree was employed on a part-time basis and was not qualified to receive retirement benefits during the 12-month period after the date of reemployment.

SB 1096 has been referred to the Senate Governmental Oversight and Accountability, and Appropriations Committees. HB 631 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee.

SB 1190: FRS Special Risk (Montford); SB 574 (Diaz); HB 803 (Aloupis)

This bill would extend membership in the FRS Special Risk Class to employees of Florida State Hospital, Sunland Center, or North Florida Evaluation and Treatment Center, who spend at least 65% of their time performing duties that involve contact with patients or inmates. Benefits would be calculated using the Special Risk multiplier (3.0%).

SB 1190 has been referred to the Senate Committee on Governmental Oversight and Accountability; Appropriations Subcommittee on Health and Human Services; and Appropriations Committee. HB 803 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee. SB 574 has been referred to Committee on Governmental Oversight and Accountability; Appropriations Subcommittee on Agriculture, Environment, and General Government; and Appropriations Committee.

H 511 Special Risk Class 911 Operators (Willhite); SB 744 (Book)

This bill would extend membership in the FRS Special Risk Class to FRS members employed as 911 public safety telecommunicators. Monthly benefits for 911 telecommunicator members would still be calculated using the Regular Class multiplier (1.6%).

HB 511 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee. SB 744 has been referred to the Senate Governmental Oversight and Accountability Committee; Appropriations Subcommittee on Agriculture, Environment, and General Government; and Appropriations Committee.

SB 1548 Death Benefits for Law Enforcement, Correctional, and Correctional Probation Officers, Firefighters and EMTs/Paramedics, and Florida Residents in the U.S. Armed Forces Killed in the Line of Duty (Rodriguez)

Section 112.19, Florida Statutes, currently provides a one-time payment to the beneficiaries of a law enforcement, correctional or correctional probation officer killed in the line of duty. $50,000 must be paid if the officer is accidentally killed in the line of duty. An additional $50,000 must be paid if the death occurred at the scene of a traffic accident, while enforcing traffic laws or ordinances or during the officer’s response to a fresh pursuit or other emergency. And $150,000 must be paid if the death was the result of an intentional act. These amounts are adjusted annually based on the Consumer Price Index. SB 1548 would increase the above amounts to $75,000, $75,000 and $200,000, respectively, and remove the annual adjustment.

SB 1548 amends section 112.191, Florida Statutes, to apply the same changes to firefighters killed in the line of duty. A new section 112.1912 would be created to provide the same line of duty death benefits to emergency medical technicians and paramedics. A new section 295.061 would also be created to provide the same death benefits to Florida residents on active duty in the United States Armed Forces, who are killed while engaged in the performance of official duties.

There is currently no House companion bill. SB 1548 has been referred to the Senate Committees on Ethics and Elections; Governmental Oversight and Accountability; and Rules.

SB 7016 FRS Employer Contributions (Government Oversight and Accountability)

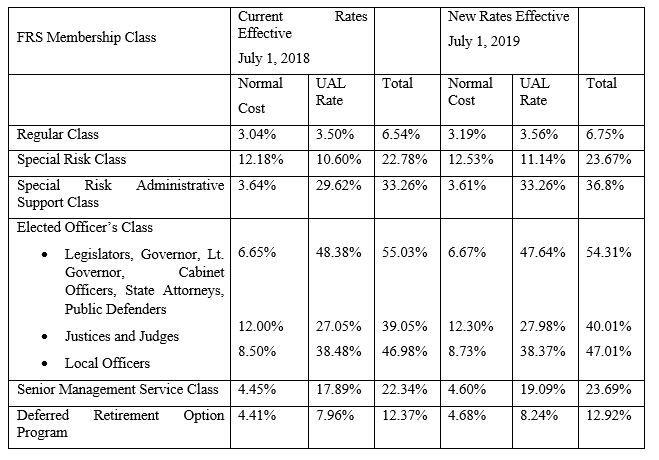

SB 7016 contains the proposed FRS employer contribution rates for the year beginning July 1, 2019. The contribution rates are intended to fund the full normal cost as well as the amortization payment for unfunded actuarial liabilities, as reflected in the actuarial valuation for fiscal year ended June 30, 2017. The bill provides the following employer contribution rates:

Note: the above employer contribution rates do not include the FRS health insurance subsidy contribution (1.66%), which is not changed in the bill; or the 0.06% employer assessment for administrative and educational expenses. Also, the above employer contribution rates do not reflect the 3% member contribution.

SB 7016 was submitted as a Committee Bill and has been reported favorably by Governmental Oversight and Accountability. It has been referred to Appropriations Committee. There is no House companion.

If you have any questions on a bill, please contact Jim Linn or Glenn E. Thomas.