2021 Retirement Legislation – End of Session Report

May 5, 2021

By: Glenn E. Thomas, Janice Rustin and Jim Linn

The 2021 legislative session ended on April 30th with the passage of only one retirement bill – the FRS employer contribution rate bill (SB 7018), which is a “must pass” measure as part of the state budget. A bill (SB 84) that would have closed the FRS pension plan for members hired on or after July 1, 2022 passed the Senate, but died in the House.

Copies of any bill can be viewed at the legislature’s website: www.leg.state.fl.us. Please feel free to contact us if you have any questions.

SB 7018 FRS Employer Contributions (Governmental Oversight and Accountability)

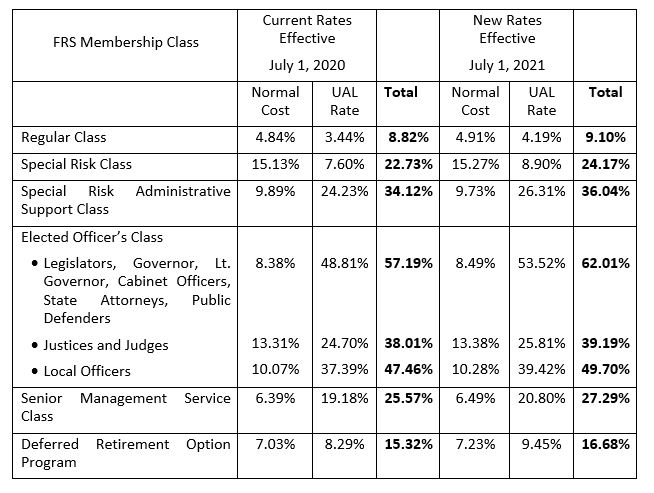

SB 7018 contains the FRS employer contribution rates for the year beginning July 1, 2021. The contribution rates are intended to fund the full normal cost as well as the amortization payment for unfunded actuarial liabilities, as reflected in the July 1, 2020 actuarial valuation. The bill provides the following employer contribution rates:

Note: the above employer contribution rates do not include the 1.66% FRS health insurance subsidy contribution; or the 0.06% employer assessment for administrative and educational expenses. Also, the above employer contribution rates do not reflect the 3% member contribution.

Although, the Senate and House agreed on the FRS employer contribution rates, they initially disagreed on a change in contribution rates to fund the health insurance subsidy for retirees. In addition to monthly retirement payments, a retiree under FRS and other state-administered retirement systems is eligible to receive monthly health insurance subsidy (HIS) payments of $5.00 per month for each year of FRS service, up to $150 per month. To fund this benefit, participating employers must contribute an amount in addition to regular employer retirement contributions. The Senate bill (SB 7018), as it initially passed the Senate, would have decreased the HIS contribution rate from 1.66% to 1.50%, effective July 1, 2021. A House companion (HB 5007) introduced on March 31st did not include the reduction in HIS contributions.

SB 7018 was passed by the Senate and sent to the House on April 7. The Senate requested that the House pass the bill as passed by the Senate or agree to include the bill in the Budget Conference. Following the adoption of an amendment removing the health subsidy contribution reduction, the House substituted SB 7018 for HB 5007 and passed the bill on April 8th. The Conference Committee recommended no reduction in health subsidy contributions. The Conference Committee recommendation was adopted and SB 7018 passed both chambers on April 30, maintaining the current 1.66% HIS contribution.

Bills That did not Pass

CS/SB 84 FRS Investment Plan (Rodrigues)

A bill that would have closed the FRS Pension Plan to new members failed to pass. Under current law, participants in the Florida Retirement System have two membership options: the defined benefit “pension plan” or the defined contribution “investment plan.” Members hired on or after January 1, 2018, are initially enrolled in the pension plan and must elect to remain in the pension plan or transfer to the investment plan by the last business day of the eighth month of employment. If they make no election, the employee is transferred to the investment plan. Thereafter, the member has one opportunity, at the employee’s discretion, to choose to move from the pension plan to the investment plan or from the investment plan to the pension plan. SB 84 would have eliminated the pension plan option for new members. Members initially enrolled in FRS on or after July 1, 2022 would have been compulsory members of the investment plan with no opportunity to transfer to the pension plan. On March 31, SB 84 was amended to exempt Special Risk Class members from compulsory participation in the Investment Plan.

Although no companion was ever filed in the House, the Senate passed SB 84 on April 8th and sent the bill to the House. The House referred the bill to four committees, none of which took up the bill.

SB 230 Special Risk Class of the Florida Retirement System (Hutson)

SB 230 would have extended membership in the FRS Special Risk Class to members employed in water, sewer, or other public works departments, who perform duties under conditions where there is a clear and present safety or health hazard that poses an imminent risk to the life and safety of the member, such as working in confined spaces or working around toxic chemicals or wastewater.

HB 477 Special Risk Class of the Florida Retirement System (Alexander); SB 1518 (Book)

HB 477 would have extended membership in the FRS Special Risk Class to members employed by the Florida State Hospital; Northeast Florida State Hospital; a developmental disability center, including Sunland Center at Marianna, Developmental Disabilities Defendant Program at Chattahoochee, and Tacachale at Gainesville; or the North Florida Evaluation and Treatment Center, who spend at least 75 percent of their time performing duties that involve contact with patients or inmates.

SB 1224 911 Operators; HB 1171 (Jones)

Section 112.1815, Florida Statutes, provides guidelines and restrictions governing benefits for firefighters, EMTs, and law enforcement officers who are injured in the line of duty from causes such as exposure to toxic substances, occupational disease, and mental or nervous injuries. Section 112.1815 currently defines the term “first responder” for purposes of that section, as

[A] law enforcement officer as defined in s. 943.10, a firefighter as defined in s. 633.102, or an emergency medical technician or paramedic as defined in s. 401.23 employed by state or local government. A volunteer law enforcement officer, firefighter, or emergency medical technician or paramedic engaged by the state or a local government is also considered a first responder of the state or local government for purposes of this section.

SB 1224 and HB 1171 would have amended the definition of first responder under section 112.1815 to include a 911 public safety telecommunicator as defined in section 401.465, Florida Statutes. In addition, the bill would have deleted language limiting this definition of first responder to section 112.1815.

The bills would have also extended membership in the FRS Special Risk Class to FRS members employed as 911 public safety telecommunicators.

HB 321 FRS Employment after Retirement of School District Personnel

Under current law, if an FRS retiree is employed by any FRS employer within 6 calendar months following retirement or deferred retirement option plan participation (DROP), termination of employment is deemed not to have occurred and the member’s retirement is voided. In this situation, the employee and employer are jointly and severally liable for repayment to FRS of all benefits received by the employee.

HB 321 would have created an exception, effective January 1, 2022, under which an FRS retiree from a regular class teaching position may be reemployed as a substitute teacher with an FRS employer immediately after retirement or DROP participation.

SB 702 Individual Retirement Accounts (Thurston); HB 253 (Geller)

Section 222.21(2)(a), Florida Statutes, exempts any assets payable to a participant or beneficiary in a fund or account from all claims of creditors of the participant or beneficiary if the fund or account is exempt from taxation under sections 401(a), 403(a), 403(b), 408, 408A, 409, 414, 457(b), or 501(a) of the Internal Revenue Code. Under section 222.21(c) any such assets that are exempt from claims of creditors do not cease to be exempt by reason of a direct transfer or eligible rollover after the owner’s death. SB 702 and HB 253 would have amended section 222.21(c) to provide that an interest in any fund or account described in section 222.21(2)(a) that is received in a transfer incident to divorce also continues to be exempt from legal process after the transfer. The changes would have been effective retroactive to transfers incident to divorce without regard to the date the transfer was made.

SB 702 was passed by the Senate, but died in messages in the House.

HB 949 Communicable and Infectious Diseases (Fetterhoff and Omphroy); SB 1314 (Gruters); SB 1422 (Thurston)

In response to the effects of COVID-19 on first responders, several bills were filed to address work-related exposure to communicable and infectious diseases. Under Section 112.181(2) Florida Statutes, any condition or impairment of health caused by hepatitis, meningococcal meningitis, or tuberculosis, resulting in the total or partial disability or death of an emergency rescue or public safety worker, is presumed to have been suffered in the line of duty, unless the contrary can be shown by competent evidence.

These bills would have added to section 112.181 a rebuttable presumption that disability or death caused by an “infectious disease” was suffered in the line of duty. “Infectious disease” would be defined as “any condition or impairment of health caused by a disease that has been declared a public health emergency in accordance with s. 381.00315.” The emergency rescue or public safety worker would be required to verify by written affidavit that, to the best of his or her knowledge and belief, he or she contracted the infectious disease during a public health emergency and was not exposed, outside of the scope of his or her employment, to any person known to have the infectious disease.

HB 1023 FRS Cost of Living Adjustment (Skidmore and Tant); SB 1310 (Polsky)

These bills would have provided a minimum cost-of-living adjustment (COLA) of at least 2% for FRS members who retire on or after July 1, 2011 with service credit earned prior to July 1, 2011. Under the current FRS statute, a 3% COLA is applied to benefits earned before July 1, 2011, but no COLA is applied to benefits earned on or after that date. Thus, the member’s COLA amount is based on the quotient of the member’s service credit earned before July 1, 2011, divided by the member’s total service credit. Under HB 1023 and SB 1310, the COLA for members with FRS service before July 1, 2011 could not be less than 2%.

HB 1609 Criminal Justice (Hardy)

Most of this 49-page bill was dedicated to the creation of a new Chapter 952, Florida Statutes: Law Enforcement and Correctional Officer Oversight. Generally, the Chapter would have required each county to establish an independent Office of Law Enforcement & Correctional Officer Oversight, with the independent authority to investigate and discipline police officers and correctional officers. It also prohibited the inclusion of disciplinary matters in collective bargaining agreements for law enforcement and correctional officers.

The bill also would have affected retirement plans, by amending section 112.3173, Florida Statutes, which provides for the forfeiture of pensions under public retirement systems. Section 112.3173(3) requires forfeiture of pension benefits of any public officer or employee who is “convicted of a specified offense committed prior to retirement, or whose office or employment is terminated by reason of his or her admitted commission, aid, or abetment of a specified offense.” HB 1609 would have amended the definition of specified offense to include:

The committing of any willful act by a law enforcement officer or correction officer that violates the law or applicable policy of the officer’s employer and leads to the death of a person or award of damages against the officer or the officer’s employer for having violated the civil rights of an individual under state or federal law.

When combined with the existing language under section 112.3173(3), HB 1609 would have required the forfeiture of pension benefits of:

- Any law enforcement officer or correction officer who is convicted of a crime, and that crime resulted in either the death of a person, or an award of damages for violation of civil rights; or

- Any law enforcement officer or correction officer whose employment is terminated by reason of his or her admitted violation of law or employer policy, and that violation resulted in either the death of a person, or an award of damages for violation of civil rights.

The bill would have also repealed section 112.532, Florida Statutes, which provides rights to law enforcement and corrections officers under investigation, and section 112.533, Florida Statutes, which provide procedures for law enforcement and correctional agencies to process and investigate complaints against law enforcement and correction officers. The bill was never placed on a committee agenda.

SB 1632 FRS Continuous Service (Ausley); HB 1327 (Alexander)

Under current law, if an FRS retiree is employed by any FRS employer within six calendar months following retirement, termination of employment will be deemed not to have occurred and the member’s retirement is voided. An FRS retiree who is reemployed with an FRS employer after meeting the definition of termination, may not receive retirement benefits and a salary until 12 months after retirement. There is an exception for a retired law enforcement officer who is reemployed as a school resource officer. Section 121.091(9)(f) permits a law enforcement officer who retires under FRS and is reemployed by an FRS employer as a school resource officer, to receive both a salary from the employer and retirement benefits beginning 6 months after retirement. Under SB 1632 and HB 1327, a law enforcement officer who retired under FRS and was reemployed by an FRS employer as a school resource officer, could have received both a salary from the employer and retirement benefits, beginning 30 days after retirement.

SB 1870 FRS Membership (Ausely); HB 1403 (Willhite)

These bills would have required any municipality, metropolitan planning organization, or special district created on or after July 1, 2021, to participate in the Florida Retirement System. Participation is currently optional for these entities.

The bills would have also changed FRS death benefits for certain beneficiaries. Under current law, if a vested FRS member dies while still employed, the member’s joint annuitant is entitled to a lifetime benefit. If the beneficiary is not a joint annuitant, the beneficiary is only entitled to a refund of the member’s contributions. Under SB 1870 and HB 1403, a beneficiary who does not qualify as a joint annuitant would have been entitled to the beneficiary benefits as provided in the option selected by the member.

The bills would also have provided an exception to the FRS reemployment restrictions for elected officials. The exception would have permitted an FRS member who retires or terminates DROP on or after July 1, 2021 to hold an elective public office in an agency covered by FRS. The elected officer would be permitted to receive retirement benefits in addition to the compensation of the elective office without regard to the time limitations otherwise imposed by FRS.

SPB 7016 Florida Retirement System Investment Plan (Governmental Oversight and Accountability)

SPB 7016 would have authorized the State Board of Administration (SBA), which administers the FRS investment plan, to develop one or more investment products to be offered to investment plan members.

It also amended procedures for married FRS members who do not designate their spouse as primary beneficiary. Under current law, the member’s spouse must sign the beneficiary designation form to acknowledge the designation. SPB 7016 would have eliminated this requirement, and instead require that the spouse “be notified and acknowledge any such designation.” If the spouse could not be located or failed to affirmatively acknowledge the designation, the member would be able to request that the acknowledgment requirement be waived by SBA through an affidavit describing the facts and circumstances.

If you have any questions on a bill, please contact Glenn E. Thomas, Janice Rustin or Jim Linn.