2019 Spring Newsletter

TABLE OF CONTENTS

- Former FDEP General Counsel Robert Angus Williams Joins LLW

- LLW Receives the 2019 Business of the Year Award from the Chamber of Commerce of the Palm Beaches

- What Is the “Seller Multiple Counter Offer”?

- Rachael Santana and Pre-law Students Present on Environmental Law Issues at the Palm Beach County Youth Law Day

- 2019 Retirement Legislation –Week Seven Session Report

- LLW Sponsored “St. Pete Day” in Tallahassee

- Christina Blackwell Earns ACEDS E-Discovery Certification

- LLW Receives 2019 “Best Law Firms” Ranking

- LLW Awards and Appointments

- LLW Events and Presentations

Former FDEP General Counsel Robert Angus Williams Joins LLW

Florida law firm Lewis, Longman & Walker (LLW) is pleased to announce Robert Angus Williams has joined the firm’s Tallahassee office as Of Counsel.

Robert joins LLW from the Florida Department of Environmental Protection, where he served as General Counsel, and before that, Chief Deputy General Counsel, serving FDEP’s Public Lands section and Defense section.

Robert has extensive experience in land use and environmental law and has worked in both public and private practice. Robert started his career as a prosecutor in Pinellas and Pasco Counties, and then spent eleven years in a land use private practice in the Tampa Bay area. Robert then moved to Tallahassee to work in the General Counsel’s office of the Florida Department of Agriculture and Consumer Services, also serving as the Clemency Aide for the former Commissioner of Agriculture, Adam Putnam.

LLW’s President and Shareholder Michelle Diffenderfer says: “We are delighted to have Robert join our firm. His exceptional reputation and experience in environmental and land use law is a big win and we appreciate the value he brings to our organization. LLW now has two former General Counsel of the Florida Department of Environmental Protection, which brings a huge benefit to our clients and the community.”

Mr. Williams can be reached at rwilliams@llw-law.com.

Lewis, Longman & Walker, P.A. Receives the 2019 Business of the Year Award from the Chamber of Commerce of the Palm Beaches

Lewis, Longman & Walker received the 2019 Business of the Year Award from the Chamber of Commerce of the Palm Beaches. LLW accepted the award at the Annual Business Awards Breakfast this week at the Palm Beach County Convention Center. Every year the Chamber recognizes a business that has achieved remarkable results and accomplishments within their industry, exemplifies excellent corporate citizenship by giving back to the local community, and possesses a corporate culture that enhances the lives of its employees.

“We are honored to receive the 2019 Business of the Year Award.” said Michelle Diffenderfer, President and Shareholder of Lewis, Longman & Walker, P.A. “We are celebrating our 25th year as a firm, and this Award recognizes our commitment to excellence, which is just as strong now as it was on day one.”

In 2014, LLW received the Chamber’s ATHENA Organizational Leadership Award, being recognized for its family-friendly work environment, mentoring programs, and support for its female employees as they pursue higher education and leadership positions.

In 2008, Michelle Diffenderfer received the ATHENA Individual Award (now called the ATHENA Leadership Award), which recognizes established leaders and mentors who assist women in reaching their full potential, demonstrate excellence in their profession, and provide valuable service by devoting time and energy to improving the lives of others in their community.

Awards were also presented for Non-Profit of the Year, Health and Human Services Organization of the Year, Diversity Organization of the Year, Young Professional of the Year, Small Business Person of the Year, and Leader of the Year. Click here to view a list of all 2019 award recipients.

What Is the “Seller Multiple Counter Offer”?

By: Richard Green

In a real estate market where existing inventory is sparse and buyers are numerous, such as Florida, the situation where a seller of real estate will receive multiple offers is not uncommon. Generally, when a seller receives multiple offers, the seller has complete control and a variety of options over how to handle those offers. The four most common options for a seller are: (1) to accept whichever offer best meets the seller’s desires; (2) essentially reject all the offers and invite the buyers to resubmit new offers[1]; (3) institute a bidding war which has similarities to an auction[2]; and (4) counter only one of the offers that is closest to the terms the seller is seeking.

However, there is another option that appears to be catching on in Florida which is known as the “Seller Multiple Counter Offer” (“SMCO”). This option allows the seller who received multiple offers to submit a counter offer to each prospective buyer containing specific terms the seller desires. The assertion is if any or all of the prospective buyers accept the counter offer, a binding contract is not created, but rather the counter offers are resubmitted to the seller who has the ultimate decision to choose which counter offer to move forward with.

This SMCO does not follow the basic contract principles in Florida. SMCO’s confuse the meaning of an offer, rejection, counter-offer, and acceptance. In order to have an enforceable contract for the sale of real estate, there must be an offer and an acceptance. The acceptance of an offer must be absolute and unconditional, identical with the terms of the offer and in the mode, at the place and within the time expressly or impliedly required by the offer.[3] The contract must contain a description of the property, the names of the buyer(s) and seller(s), a price term and whether there are any financing contingencies, and must be signed by the parties.[4][5]

If a seller responds to an offer from a buyer with a counteroffer, the counteroffer acts to reject the initial offer from the buyer.[6] If the counteroffer is rejected by the buyer, the seller cannot accept the original offer. Likewise, if the buyer does not accept the seller’s counteroffer as submitted, but changes the offer in any manner, then the buyer has rejected the counteroffer and submitted his or her own counteroffer. This process continues until there is an explicit offer with defined terms and an acceptance which mirrors the offer.[7]

Click here to view the full article.

Rachael Santana and Pre-Law Students Present on Environmental Law Issues at the Palm Beach County Youth Law Day

On February 23rd, LLW attorney Rachael Santana and high school volunteers from The King’s Academy Pre-Law Program worked together to create interactive presentations on the delicate balance between environmental protection and other important values, such as private property rights. The King’s Academy students got to learn about Environmental Law issues and assisted in creating poster boards on Lake Okeechobee algal blooms, beach access and beach restoration, Turkey Point power generation for Miami, and protection of the Florida Springs. They shared what they learned to middle school students at Palm Beach County Youth Law Day 2019. Rachael and LLW are excited to help educate Florida’s up and coming lawyers and leaders about our unique environment and the challenges we face today and in the future.

2019 Retirement Legislation – Week Seven Session Report

The 2019 regular session of the Florida Legislature convened on March 5, 2019, and is scheduled to adjourn on May 3, 2019. A bill setting employer contribution rates for the Florida Retirement System has passed and was signed by the Governor. There was movement in the House this week on the firefighter cancer bill, which now appears poised to pass in both chambers. A summary of all retirement bills follows.

Copies of any bill can be viewed at the legislature’s website: www.leg.state.fl.us. Please feel free to contact us if you have any questions.

Bills That Have Passed

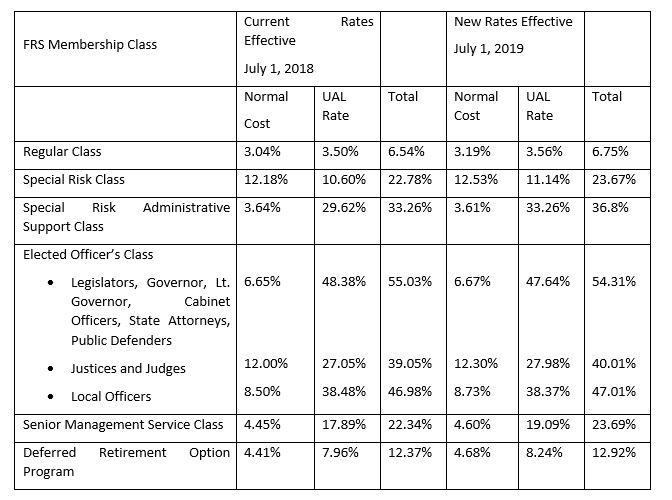

SB 7016 FRS Employer Contributions (Government Oversight and Accountability)

SB 7016 contains the FRS employer contribution rates for the year beginning July 1, 2019. The contribution rates are intended to fund the full normal cost as well as the amortization payment for unfunded actuarial liabilities, as reflected in the actuarial valuation for fiscal year ended June 30, 2017. The bill provides the following employer contribution rates:

Note: the above employer contribution rates do not include the FRS health insurance subsidy contribution (1.66%), which is not changed in the bill; or the 0.06% employer assessment for administrative and educational expenses. Also, the above employer contribution rates do not reflect the 3% member contribution.

SB 7016 passed and has been signed into law by the Governor.

Bills That May Pass

SB 426 Firefighter Cancer (Flores); HB 857 (Willhite); HB 7129 (State Affairs Committee)

These bills create a new section 112.1816, entitled “Firefighters; cancer diagnosis.” Upon a diagnosis of cancer, a firefighter is entitled to the following benefits, as an alternative to pursuing workers’ compensation benefits:

- Cancer treatment, covered by an employer health plan at no cost to the firefighter

- A one-time cash payout of $25,000 upon initial diagnosis

These benefits must be available for 10 years following the date the firefighter terminates employment, unless the firefighter is reemployed by any employer as a firefighter.

To be eligible for the benefits, the firefighter must have been with the same employer for 5 continuous years, not used tobacco products for the last 5 years, and not been employed in another position with a higher risk of cancer in the last five years.

For purposes of determining leave time and employee retention policies, the employer must consider a firefighter’s cancer diagnosis as an injury or illness incurred in the line of duty.

Firefighter retirement plans must consider a firefighter totally and permanently disabled if he or she is prevented from rendering useful and effective service as a firefighter and is likely to remain disabled continuously and permanently due to the diagnosis of cancer or circumstances that arise out of the treatment of cancer. Similarly, if a firefighter dies as a result of cancer or circumstances that arise out of the treatment of cancer, the plan must consider the firefighter to have died in the line of duty.

If there is no retirement plan, the employer must provide a disability retirement plan that provides the firefighter with at least 42% of his or her annual salary, at no cost to the firefighter, until the firefighter’s death, for total and permanent disabilities attributable to the diagnosis of cancer which arise out of the treatment of cancer. The employer must also provide a death benefit to the firefighter’s beneficiary, at no cost to the firefighter or his or her beneficiary, totaling at least 42% of the firefighter’s most recent annual salary for at least 10 years following the firefighter’s death.

Firefighters who die as a result of cancer or circumstances that arise out of the treatment of cancer are considered to have died in the manner described in section 112.191(2)(a)[death while performing duties], which provides a $50,000 one-time payment to the firefighter’s beneficiary.

The Division of State Fire Marshal within the Department of Financial Services must adopt rules to establish employer cancer prevention best practices as it relates to personal protective equipment, decontamination, fire suppression apparatus, and fire stations.

A Committee Substitute for SB 426 by the Community Affairs Committee made several changes to funding provisions in the bill.

- The bill originally required cancer treatment to be provided at no cost to the firefighter, under employer-sponsored health plan or through a group health insurance trust fund. The original language provided “The health plan, trust fund, or insurance policy, or a rider added to such policy, may not require the firefighter to contribute toward any deductible, copayment, or coinsurance amount for the treatment of cancer.”

The CS removes the requirement that the cancer treatment be provided at no cost to the firefighter. The sentence: “The health plan, trust fund, or insurance policy, or a rider added to such policy, may not require the firefighter to contribute toward any deductible, copayment, or coinsurance amount for the treatment of cancer” is deleted. However, whereas the original bill permitted employers to reimburse firefighters for any out-of-pocket deductible, copayment, or coinsurance costs incurred, the CS requires the employer to do so.

- The original language also said that the benefits in subsections 112.1816(2)(a) and (b) (cancer treatment and $25,000 payment) must be made available for 10 years after the firefighter terminates employment. Under the CS, the benefits specified in paragraphs (2)(a) and (b) must be made available for 10 years only if the firefighter elects to continue coverage in the employer sponsored health plan or group health insurance trust fund after he or she terminates employment.

- Proposed subsection 112.1816(3)(a) would require retirement plans to consider a firefighter totally and permanently disabled if they are prevented from rendering useful and effective service as a firefighter due to cancer. The CS clarifies that the retirement plan must consider the firefighter totally and permanently disabled in the line of duty.

- Subsection 112.1816(5) originally would have required that the costs of purchasing an insurance policy that provides cancer benefits be borne solely by the employer. The CS eliminates that language, and now states that the costs of providing the reimbursement, lump sum, and retirement benefits must be borne solely by the employer.

CS/SB 426 was further amended on April 11th, when the Appropriations Committee – the final committee stop for CS/SB 426 – approved another committee substitute for CS/SB 426. The most recent version includes an amendment to section 121.735, Florida Statutes, which provides for allocations from the Florida Retirement System Contributions Clearing Trust Fund for line-of-duty death benefits for FRS Investment Plan Members. Special Risk allocation percentage would be increased from 1.15% to 1.21%. In addition to this change, in order to fund the benefit changes to the Florida Retirement System under CS/CS/SB 426, the required FRS employer contribution rates would be increased as follows:

- By 0.08 percentage point for the rate established in s. 121.71(4), Florida Statutes, for the Special Risk Class.

- By 0.01 percentage point for the rate established in s. 121.71(5), Florida Statutes, for the Special Risk Class.

- By 0.02 percentage point for the rate established in s. 121.71(5), Florida Statutes, for DROP.

CS/SB 426 has passed all Senate committees, and is now on the Senate Special Order Calendar, awaiting floor action. HB 857 has not been heard by any House committee. However this week HB 7129 emerged as a committee bill by the House State Affairs Committee. HB 7129 is substantially similar to CS/SB 426, and is now on the House Special order calendar, awaiting floor action.

Bills That Are Not Expected to Pass

SB 402 FRS Reemployment of School Personnel (Gruters); HB 137 (Good)

SB 402 would allow teachers who retired under the Florida Retirement System to be reemployed as substitute teachers within 6 months of retirement or deferred retirement option plan participation (DROP). The reemployed substitute teachers would not renew membership or receive additional service credit under FRS. The bill requires the Department of Management Services to obtain a Private Letter Ruling (PLR) from the Internal Revenue Service to confirm that the legislation does not violate the requirements for qualification under section 401(a) of the Internal Revenue Code.

Neither SB 402 nor HB 137 has been heard in committee this year.

SB 784 FRS Cost of Living Adjustment (Gruters); HB 779 (Clemons, Willhite)

These bills would provide a minimum cost-of-living adjustment (COLA) of at least 2% for FRS members who retire on or after July 1, 2011 with service credit earned prior to July 1, 2011. Under the current FRS statute, a 3% COLA is applied to benefits earned before July 1, 2011, but no COLA is applied to benefits earned on or after that date. Thus, the member’s COLA amount is based on the quotient of the member’s service credit earned before July 1, 2011, divided by the member’s total service credit. Under SB 784, the COLA for members with FRS service before July 1, 2011 could not be less than 2%.

SB 784 has been approved by Government Oversight and Accountability, and is now in Appropriations Subcommittee on Agriculture, Environment and General Government. HB 779 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee. It has not been placed on a committee agenda.

HB 1091 Pension of Retired Deputy Scot Peterson (Roach); SB 1450 (Gruters)

These bills declare that Deputy Scot Peterson, who recently retired from the Broward County Sheriff’s Office, shall forfeit all rights & benefits under the Florida Retirement System due to “his wanton or willful neglect in performance of his assigned duties & contravention of his oath of office.” in connection with his response to the 2018 mass shooting incident at Marjory Stoneman Douglas High School. HB 1091 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee. SB 1450 has been referred to the Senate Governmental Oversight and Accountability; Judiciary; and Appropriations Committees. No action has been taken on the bill.

SB 1096 FRS Reemployment after Retirement (Perry); HB 631 (Watson)

Under current law, an FRS member who retired or ended DROP participation before July 1, 2010 may be reemployed by an FRS employer if the reemployment occurs at least one calendar month after retirement. However, the member may not receive both a salary and retirement benefits for 12 months after retirement. If a member is reemployed while receiving retirement benefits the member must notify the employer and FRS, and benefits are suspended until the 12-month period concludes. Under SB 1096, a member could have been reemployed by an employer participating in the FRS before completion of the 12-month limitation period if the retiree was employed on a part-time basis and was not qualified to receive retirement benefits during the 12-month period after the date of reemployment.

Neither SB 1096 nor HB 631 has been heard in committee this year.

SB 1190: FRS Special Risk (Montford); SB 574 (Diaz); HB 803 (Aloupis)

This bill would extend membership in the FRS Special Risk Class to employees of Florida State Hospital, Sunland Center, or North Florida Evaluation and Treatment Center, who spend at least 65% of their time performing duties that involve contact with patients or inmates. Benefits would be calculated using the Special Risk multiplier (3.0%).

SB 1190 has been referred to the Senate Committee on Governmental Oversight and Accountability; Appropriations Subcommittee on Health and Human Services; and Appropriations Committee. HB 803 has been referred to the House Oversight, Transparency and Public Management Subcommittee; Appropriations Committee; and State Affairs Committee.

A committee substitute for SB 574 by Governmental Oversight and Accountability makes it clear that to be special risk a correctional officer’s primary duties and responsibilities must be the custody, and physical restraint of prisoners or inmates if necessary. Under original language in SB 574, duties had to “include” those functions. CS/SB 574 has been approved by Committee on Governmental Oversight and Accountability. It has also been referred to Appropriations Subcommittee on Agriculture, Environment, and General Government; and Appropriations Committee.

HB 511 Special Risk Class 911 Operators (Willhite); SB 744 (Book)

This bill would extend membership in the FRS Special Risk Class to FRS members employed as 911 public safety telecommunicators. Monthly benefits for 911 telecommunicator members would still be calculated using the Regular Class multiplier (1.6%).

Neither HB 511 nor SB 744 has been heard in committee this year.

SB 1548 Death Benefits for Law Enforcement, Correctional, and Correctional Probation Officers, Firefighters and EMTs/Paramedics, and Florida Residents in the U.S. Armed Forces Killed in the Line of Duty (Rodriguez); HB 7105 (Oversight, Transparency and Public Management Subcommittee) and SB 7098 (by Governmental Oversight and Accountability)

Section 112.19, Florida Statutes, currently provides a one-time payment to the beneficiaries of a law enforcement, correctional or correctional probation officer killed in the line of duty. $50,000 must be paid if the officer is accidentally killed in the line of duty. An additional $50,000 must be paid if the death occurred at the scene of a traffic accident, while enforcing traffic laws or ordinances or during the officer’s response to a fresh pursuit or other emergency. And $150,000 must be paid if the death was the result of an intentional act. These amounts are adjusted annually based on the Consumer Price Index. SB 1548 would increase the above amounts to $75,000, $75,000 and $200,000, respectively, and remove the annual adjustment.

SB 1548 amends section 112.191, Florida Statutes, to apply the same changes to firefighters killed in the line of duty. A new section 112.1912 would be created to provide the same line of duty death benefits to emergency medical technicians and paramedics. A new section 295.061 would also be created to provide the same death benefits to Florida residents on active duty in the United States Armed Forces, who are killed while engaged in the performance of official duties.

HB 7105 and SB 7098 would increase the payment amounts to 75,000, 75,000 and 225,000, respectively.

These bills would also provide for a waiver of educational expenses for children of first responders killed in the line of duty. HB 7105 has been approved by Appropriations Committee; now in State Affairs Committee. SB 7098 was approved by the Governmental Oversight and Accountability Committee and the Appropriations Subcommittee on Agriculture, Environment, and General Government. It is now in its final committee – Appropriations.

SB 1548 has been referred to the Senate Committees on Ethics and Elections; Governmental Oversight and Accountability; and Rules. No action has been taken on the bill.

If you have any questions on a bill, please let us know.

LLW Sponsored “St. Pete Day” in Tallahassee

LLW was the presenting sponsor of the St. Petersburg Chamber of Commerce “St. Pete Day” March 20th in Tallahassee. Attendees on this two-day trip met with legislators, received briefings from the Florida Chamber of Commerce, got a private tour of the Governor’s Mansion, and had opportunities to observe the legislative process first hand from the House and Senate Galleries. The main event was held at the Capitol Courtyard where legislators, staffers and visitors experienced what makes St. Petersburg great in an evening celebration. Click here to read more.

Christina Blackwell Earns ACEDS E-Discovery Certification

LLW paralegal Christina Blackwell recently earned a Certified E-Discovery Specialist (CEDS) designation from the Association of Certified E-Discovery Specialists (ACEDS). The CEDS credential is earned by individuals who pass a comprehensive four-hour examination that provides a tough and objective measure of an individual’s mastery of all aspects of e-discovery. Ms. Blackwell also recently earned an advanced certificate in the area of e-discovery from the National Association of Legal Assistants (NALA). The mission of ACEDS is to help professionals in various disciplines improve and certify their e-discovery knowledge and skill, increase their contacts, and increase overall competence in e-discovery and related fields. For more information about ACEDS, visit https://www.aceds.org/.Ms. Blackwell has served as a paralegal for over 18 years. She assists attorneys in the areas of environmental, land use, and local government law and assists in all phases of litigation of federal, state, and administrative matters involving private and governmental clients.

LLW Receives 2019 “Best Law Firms” Ranking

LLW received the 2019 “Best Law Firms” Ranking by U.S. News & World Report. The firm’s Jacksonville, Tallahassee and West Palm Beach offices received Tier 1 rankings in Environmental Law and Environmental Litigation. Rankings are determined by a combination of hard data, peer reviews and client assessments. Best Law Firms® lists are excerpted in a wide range of general interest, business and legal publications worldwide, reaching an audience of more than 10 million readers.

In addition to receiving the “Best Law Firms” ranking, eight LLW attorneys were recognized in August by their peers for inclusion in the Best Lawyers in America.© 2019 by U.S. News – Best Lawyers®. Click here to review the list. For more information on “Best Law Firms” rankings, visit http://bestlawfirms.usnews.com.

Kevin Hennessy was recently appointed as Chair of the St. Petersburg Chamber of Commerce Transportation Committee. The Committee’s role is to focus on improving both regional accessibility (mass transit and interstates/expressways) and urban mobility (micro-transit, Complete Streets, and transit corridors).

LLW was recently listed in the “Top 100 South Florida Law Firms List” by South Florida Business & Wealth Magazine.

LLW’s St. Petersburg office was recently selected for inclusion in the Tampa Bay Business Journal’s 2019 “Largest Tampa Bay Law Firms” List. Ranked law firms are from Hernando, Hillsborough, Manatee, Pasco, Pinellas, Polk and Sarasota counties.

LLW Chief Financial Officer Stuart Maslanik was recognized by the Association of Legal Administrators (ALA) as a Certified Legal Manager. Stuart is one of about 5% of the total ALA membership that has passed this exam.

LLW sponsored the Pine Jog @ Night Reception on April 13th in West Palm Beach. Proceeds from the event benefitted the Pine Jog Environmental Education Center Programs. LLW attorney Kathryn Rossmell serves as a Board Member. https://fauf.fau.edu/PJatNight/

LLW was a sponsor of the St. Lucie County 15th Annual Earth Day Festival on April 13th. https://www.stlucieco.gov/departments-services/a-z/oxbow-eco-center/earth-day-at-the-oxbow-eco-center

LLW sponsored the Southern Scholarship Foundation Virtual 5K Race April 8-12th. The foundation supports students who lack financial resources, demonstrate excellent academic merit, and exemplify good character, attend institutions of higher education. https://www.southernscholarship.org/wp-content/uploads/2019/01/website-education-for-life-5k-1.pdf

LLW St. Petersburg attorneys attended the St. Petersburg Bar Association April Membership Meeting on April 5th in St. Petersburg. LLW was a sponsor of the event. https://www.stpetebar.com/events/EventDetails.aspx?id=1185161&group

Chris Johns attended the American Bar Association Water Law Conference March 26-27th in Denver. https://www.americanbar.org/events-cle/mtg/inperson/343158082/

LLW sponsored the Florida Ports Council Spring Board Meeting and Legislative Forum March 26-27th in Tallahassee. http://flaports.org/event/florida-ports-council-spring-board-meeting-legislative-forum-3/

Steve Walker and Telsula Morgan attended the American Bar Association SEER Spring Conference March 27-29th in Denver. https://www.americanbar.org/events-cle/mtg/inperson/343159962/

Richard Green and Nicole Poot attended the Port Manatee Propeller Club’s Porthole Tournament March 23rd in Palmetto. http://manatee.propellerclub.us/home

LLW sponsored the Northeast Florida League of Cities dinner March 21st in Green Cove Springs.

LLW sponsored the Coral Springs Festival of Arts & Crafts March 16-17th in Coral Springs. http://www.artfestival.com/festivals/coral-springs-festival-arts-crafts

Brenna Durden participated in a panel discussion “Women Lawyers in Jacksonville: Past, Present and Future” at the Jacksonville Women Lawyers Association Luncheon March 14th.http://events.r20.constantcontact.com/register/event?llr=vrsbmtkab&oeidk=a07eg2zsumm77cdf2b1

LLW sponsored the annual Love of Literacy Luncheon March 14th in West Palm Beach. Proceeds from the event will support the Literacy Coalition of Palm Beach County. https://www.literacypbc.org/event/love-of-literacy-luncheon/

LLW attorneys attended the Florida Association of Special Districts Legislative Forum March 13th in Tallahassee. https://fasd.com/events/legislative-forum/

LLW participated in the Jacksonville Bar Association YLS Chili Cook-off February 16th benefiting BEST BUDDIES. https://www.bestbuddies.org/florida/

LLW sponsored the St. Petersburg Chamber of Commerce Legislative Preview February 15th in St. Petersburg.

Glenn Thomas presented “Pensions and PTSD Workers Compensation” at the Florida Public Employer Labor Relations Association Annual Training Conference February 12th in Orlando. http://fpelra.org/education/annual-training-conference/

Fred Aschauer presented “Dredging and Environmental Issues” at the American Association of Port Authorities Port Administration and Legal Issues Seminar February 12th in Ft. Lauderdale. https://my.aapa-ports.org/Public/Events/Event_Display.aspx?EventKey=19ADMLEGAL

Rachael Santana attended the Public Interest Environmental Conference February 7-9th in Gainesville. LLW was a proud sponsor. https://ufpiec.org/

LLW sponsored the North Florida Land Trust’s Annual Meeting February 7th in Jacksonville. https://904tix.com/events/2019-annual-meeting.

LLW sponsored the Northeast Florida Regional Council Farewell Luncheon February 7th in Jacksonville in honor of CEO Brian Teeple. https://www.nefrc.org/

Fred Aschauer attended the Florida Shore and Beach Preservation Association National Conference on Beach Preservation Technology February 6-8th in St. Augustine. LLW was a proud sponsor. https://fsbpa.com/tech-conference.html

Fred Aschauer attended the Florida Airports Council State Legislative Fly-In February 4-6th in Tallahassee https://www.floridaairports.org/meetings-and-events/Meetings?id=151

LLW’s St. Petersburg Office and their families participated in the 2019 MLK Build Day hosted by Habitat for Humanity of Pinellas County. Volunteers from across Pinellas County came together to paint and beautify five St. Petersburg homes. https://habitatpinellas.org/

LLW attorneys attended the St. Petersburg Chamber of Commerce 120th Annual Meeting on January 24th. http://www.stpete.com/annualmeeting.html

Brenna Durden attended the Environmental Bankers Association Winter Conference January 20-23rd in New Orleans. https://www.envirobank.org/page/NewOrleansTeaser

LLW attorneys attended the Place of Hope Sporting Clays Fun Shoot January 18th in Palm City. Proceeds from the event directly support the mission of Place of Hope—to bring hope and healing to abused and neglected youth in foster care in Palm Beach County. https://www.placeofhope.com/clay-shoot/

LLW sponsored the Junior League of Tallahassee (JLT) Sunshine State Ball on January 11th in Tallahassee. JLT is a nonprofit organization of women committed to improving the lives of children and families through the effective action and leadership of trained volunteers. http://www.jltallahassee.org/fundraisers/sunshine-state-ball/