2019 Summer Newsletter

TABLE OF CONTENTS

- Celebrating 25 Years of Growth, Change and Success

- LLW Makes Top 100 Best Companies List

- Michelle Diffenderfer Receives the Florida Bar Environmental and Land Use Law Section’s Bill Sadowski Memorial Outstanding Service Award

- Tara Duhy Selected for the 38th Class of Leadership Florida Cornerstone

- LLW Moving West Palm Beach Office to 360 Rosemary

- LLW Attorneys Recognized as 2019 Florida Super Lawyers and Rising Stars

- LLW Attorneys Named Florida Legal Elite

- LLW Ranked in South Florida Business Journal’s 2019 Top Law Firms List

- LLW Shareholders Named Top Lawyers by Palm Beach Illustrated Magazine

- Janice Rustin Receives Board Certification in City, County and Local Government Law

- Kasey Lewis Joins LLW’s Tallahassee Office as a Legislative Coordinator

- 2019 Retirement Legislation – Final Report

- LLW Participated in the St. Petersburg Bar Association’s Health & Wellness Challenge

- Summer Conferences and Presentations

Celebrating 25 Years of Growth, Change and Success

LLW Makes Top 100 Best Companies List

Florida law firm Lewis, Longman & Walker, P.A. was recently named one of Florida’s Best Companies To Work For.

The annual Best Companies list is featured in the August issue of Florida Trend magazine. One-hundred companies are ranked in small, medium and large employer categories.

Companies that chose to participate underwent an evaluation of their workplace policies, practices, philosophy, systems and demographics. The process also included a survey to measure employee satisfaction. The combined scores determined the top companies and the final ranking.

“These best companies have figured it out!” says Florida Trend Publisher David Denor. “Providing their employees with an environment and culture that promotes growth both professionally and personally—all while delivering workplace benefits that lift employee morale and create loyalty… these best companies offer lessons we can all learn from.”

The Best Companies To Work For In Florida program was created by Florida Trend and Best Companies Group and is endorsed by the HR Florida State Council. Best Companies Group managed the registration, survey and analysis and determined the final rankings. For a list of the 100 Best Companies To Work For In Florida, go to FloridaTrend.com/BestCompanies.

Lewis, Longman & Walker recently celebrated its 25th anniversary by donating 25,000 meals to local food banks, click here to view the 25th anniversary video.

Michelle Diffenderfer Receives the Florida Bar Environmental and Land Use Law Section’s Bill Sadowski Memorial Outstanding Service Award

LLW Shareholder and President Michelle Diffenderfer was presented with the Bill Sadowski Memorial Outstanding Service Award by the Environmental and Land Use Law Section (ELULS) of the Florida Bar on June 27th in Boca Raton. The award recognizes individuals that have demonstrated outstanding public service in the areas of environmental and land use law.

The award is named after William (Bill) Edward Sadowski, a prominent environmental attorney and legislator who advocated for stronger protection of the state’s fragile environment and enforcement of growth management laws. Bill died tragically in an airplane crash in 1992.

During her 25-year career, Michelle has been honored with numerous awards, many for her work in environmental law. Michelle had the great honor to receive the Florida Bar’s ELULS Judy Florence Memorial Outstanding Service Award in recognition and appreciation for outstanding service and dedication. Michelle is also the recipient of the Florida Commission on the Status of Women Achievement Award, the Girl Scouts of Southeast Florida Emerald Environmental Leadership Award, and the Caribbean-American Democratic Club of Palm Beach County Community Change Maker Award for Environmental Advocacy.

Michelle has been named a Top Lawyer in Environmental Law by the South Florida Legal Guide, a Legal Elite by Florida Trend Magazine and a Florida Super Lawyer in Environmental Law. Michelle is a Fellow of the American College of Environmental Lawyers, and is a member of the Florida Association of Environmental Professionals. Michelle is the Budget Officer for the American Bar Association’s Section of Environment, Energy and Resources and is Past Chair of the ELULS. For more information about Michelle, click here.

Tara Duhy Selected for the 38th Class of Leadership Florida Cornerstone

LLW Executive Shareholder Tara Duhy has been accepted into the 38th Class of Leadership Florida Cornerstone. Ms. Duhy is one of only 56 individuals from across the state to be selected. These Florida leaders are chosen for their outstanding abilities, passion for the state, and commitment to help make great things happen for Florida. Ms. Duhy will participate in an eight-month learning experience that will take them to communities across Florida. LLW Shareholders Michelle Diffenderfer and Brenna Durden are graduates of Leadership Florida.

The mission of Leadership Florida is to continually discover and convene committed individuals, enhancing and recharging their leadership skills by introducing them to a powerful community through whom they find knowledge and inspiration. The Cornerstone program includes sessions on issues critical to Florida, leadership skills assessment and training, and relevant information on Florida’s history, demography, diversity, and opportunities.

LLW Moving West Palm Beach Office to 360 Rosemary

Related Companies recently announced that top-ranked Florida law firm Lewis, Longman & Walker (LLW) will relocate its West Palm Beach office to 360 Rosemary in the Rosemary Square neighborhood. The 20-story, 300,000-square-foot, sustainable Class-A office building is already attracting some of the region’s most influential financial and professional services firms including Comvest Partners, that announced their lease in June. The building is expected to open end of 2020.

“We are thrilled to be relocating to 360 Rosemary, as it aligns with our firm’s culture of creating a dynamic live, work and play lifestyle for employees,” said Tara W. Duhy, Executive Shareholder of LLW’s West Palm Beach office. “We are excited to design a modern, cutting-edge workspace in the epicenter of Rosemary Square and West Palm Beach appropriate for today’s talent base of lawyers.”

“We are pleased to welcome Lewis, Longman & Walker as the first law firm to call 360 Rosemary home,” said Gopal Rajegowda, Senior Vice President of Related Companies. “LLW places a strong emphasis on cultivating a dynamic workplace culture, which is a core amenity of the building located steps away from a diverse collection of shopping, dining, wellness, and cultural amenities. They will be a great complement to a growing roster of likeminded tenants who are focused on the attraction and retention of world-class talent who are relocating to the Rosemary Square neighborhood.”

LLW has signed a 12,366-square-foot lease at 360 Rosemary that will allow the firm to be flexible and responsive to their growing business and clients’ needs. Founded 25 years ago, the firm boasts a roster of 34 attorneys statewide with expertise in environmental, land use, real estate, litigation, legislative and governmental affairs. The firm also has offices in Jacksonville, St. Petersburg, Tampa, and Tallahassee.

Jon Blunk, President of Tower Commercial Real Estate, is the exclusive leasing agent for 360 Rosemary and represented Related in the transaction. LLW was represented by CBRE First Vice President Kevin Probel, First Vice President Kevin McCarthy, and Vice President Will Portfolio.

Anticipated LEED Gold, 360 Rosemary is a Class-A office building designed by Elkus Manfredi Architects and Leo A. Daly that will bring state-of-the-art, connected and innovative workspaces to South Florida. The 20-story modern building will offer loft-style office space with expansive floor-to-ceiling windows that maximize natural light and 10,000 square feet of outdoor amenity space including two terraces that allow for an exceptional indoor/outdoor workplace environment. Located adjacent to the Brightline high-speed rail station which connects West Palm Beach with Miami and Fort Lauderdale, on 10 local bus routes and just 3 miles from the Palm Beach International airport, the building offers unparalleled access to local transportation hubs. The building is expected to be complete in early 2021.

For more information about 360 Rosemary, please visit http://www.cityplace.com/360rosemary/.

Lewis, Longman & Walker Attorneys Recognized as 2019 Florida Super Lawyers and Rising Stars

LLW attorneys have recently been selected as 2019 Florida Super Lawyers. Terry Lewis, Michelle Diffenderfer and Alfred Malefatto from the firm’s West Palm Beach office have been selected in the area of Environmental Law. Anne Longman from the Tallahassee office has been selected in the area of Administrative Law and Wayne Flowers from the Jacksonville office has been selected in the area of Environmental Litigation.

These attorneys share this designation with only 5% of the attorneys in Florida. Super Lawyers are nominated by fellow attorneys who have personally observed them in action, whether as opposing counsel, co-counsel or through other firsthand observations in the courtroom. The background and professional achievement of each candidate are researched before the final decision is made to include the attorneys in this list. For more information, visit www.superlawyers.com.

LLW Attorneys Brenna Durden and Fred Aschauer Recognized by Florida Trend Magazine as 2019 Legal Elite

LLW is pleased to announce that Brenna Durden and Fred Aschauer have been named 2019 Florida Legal Elite in the area of Environmental and Land Use Law.

The select group of Florida Legal Elite earned the prestigious title by votes cast by their peers from across the state. Florida Trend Magazine’s Legal Elite list represents less than two percent of the active Florida Bar members who practice in Florida. For more information about Florida Legal Elite, visit www.floridatrend.com/legal-elite.

LLW Ranked in South Florida Business Journal’s 2019 Top Law Firms List

LLW was recently included in the 2019 Top Law Firms List, published by the South Florida Business Journal. LLW has been included in the Top Law Firms list since its inaugural edition in 2014. South Florida law firms are ranked by the total number of attorneys, shareholders, staff and South Florida offices.

LLW Shareholders Named Top Lawyers by Palm Beach Illustrated Magazine

Four LLW Shareholders have been named Top Lawyers by Palm Beach Illustrated Magazine. Michelle Diffenderfer, Terry Lewis and Stephen Walker were named Top Lawyers in the area of Environmental Law, and Alfred Malefatto was named a Top Lawyer in the area of Land Use and Zoning Law.

Published annually, the selection process involves a peer-reviewed nomination survey conducted by Palm Beach Illustrated and Professional Research Services. For more information, visit https://www.palmbeachillustrated.com/.

Janice Rustin Receives Board Certification in City, County and Local Government Law

LLW attorney Janice Rustin recently earned Florida Bar Board Certification in City County and Local Government Law, sharing this designation with only seven percent of all lawyers in Florida. Board certification is the highest level of recognition by The Florida Bar.

Ms. Rustin’s practice focuses on public pension, local government, and land use law. She advises public employers and pension boards on federal and state laws pertaining to governmental retirement plans and works closely with local governments and pension actuaries in restructuring retirement benefit programs and preparing pension plan documents and amendments. She can be reached at jrustin@llw-law.com or at 561.640.0820.

Kasey Lewis Joins Lewis, Longman & Walker, P.A.

Lewis, Longman & Walker, P.A. is pleased to announce that Kasey Lewis has joined the firm’s Tallahassee office as a Legislative Coordinator.

Kasey previously served as a Legislative Assistant to Florida State Senator Lori Berman and to Florida State Representative Matt Willhite. She also served as a Field Organizer for the 2016 Hillary for America campaign.

In 2018, Kasey served as the Fundraising and Finance Chair for the New Leaders Council Palm Beach Board of Directors.

Kasey received her Bachelor of Arts degree in Political Science and holds certificates in Public Affairs and Political Campaigning from the University of Florida. She is currently pursuing a Master of Public Administration and Policy degree from the American University. She can be reached at (850) 222-5702 or at klewis@llw-law.com.

2019 Retirement Legislation Report

By: Jim Linn and Glenn Thomas

The 2019 Legislative Session officially ended on May 4th. A bill providing cancer benefits for firefighters has passed and was signed into law by the Governor on May 3rd. A bill setting employer contribution rates for the Florida Retirement System has passed and was also signed by the Governor. A summary of all retirement bills follows.

Copies of any bill can be viewed at the legislature’s website: www.leg.state.fl.us. Please feel free to contact us if you have any questions.

Bills That Passed

SB 426 Firefighter Cancer (Flores); HB 857 (Willhite); HB 7129 (State Affairs Committee)

A committee substitute for SB 426, which establishes cancer benefits for firefighters, has passed the Legislature and has been signed by the Governor. Under current Florida law, it is presumed that certain illnesses (e.g. heart disease, hypertension) are accidental and suffered in the line of duty for purposes of determining the cause of disability or death of a firefighter. The current law creates a presumption that may be rebutted by competent evidence, and requires that the firefighter have passed a physical examination prior to employment.

In contrast to the current presumption laws, SB 426 creates a new section 112.1816, Florida Statutes, which provides two new employer-funded benefits, and enhances existing disability and death benefits for any firefighter diagnosed with certain types of cancer. Unlike other statutory presumptions, SB 426 simply directs that benefits be provided to firefighters who meet several eligibility requirements and are diagnosed with cancer. There is no opportunity for the employer to demonstrate the contrary by competent evidence, and no requirement that a firefighter have undergone a medical exam prior to employment.

The bill defines “cancer” to include:

- Bladder cancer.

- Brain cancer.

- Breast cancer.

- Cervical cancer.

- Colon cancer.

- Esophageal cancer.

- Invasive skin cancer.

- Kidney cancer.

- Large intestinal cancer.

- Lung cancer.

- Malignant melanoma.

- Multiple myeloma.

- Non-Hodgkin’s lymphoma.

- Oral cavity and pharynx cancer.

- Ovarian cancer.

- Prostate cancer.

- Rectal cancer.

- Stomach cancer.

- Testicular cancer.

- Thyroid cancer

Under the new law the term “firefighter” means an individual employed as a full-time firefighter “whose primary responsibilities are the prevention and extinguishing of fires; the protection of life and property; and the enforcement of municipal, county and state fire prevention codes and laws pertaining to the prevention and control of fires.” Volunteer firefighters are not included in the definition. In contrast, section 112.191, Florida Statutes, which provides a one-time monetary payment for firefighters killed in the line of duty, includes volunteer firefighters in the definition of “firefighter.”

New Cancer Benefits

The new benefits are described in subsection 112.1816(2) as an alternative to workers’ compensation benefits. Any firefighter meeting the eligibility requirements described below is entitled to the benefits upon a diagnosis of cancer. The benefits include:

- Cancer treatment within the employer’s health plan or a group insurance trust, with any deductible, copayment and coinsurance costs related to cancer treatment reimbursed by the employer; and

- A one-time payment of $25,000 at the time of the initial diagnosis.

In addition to these benefits, for purposes of determining leave time and employee retention policies, an employer must consider a firefighter’s cancer diagnosis as an injury or illness incurred in the line of duty.

Eligibility Requirements

To be eligible for the cancer benefits outlined above, a firefighter:

- Must have been employed by his or her employer for at least 5 continuous years;

- Must not have used tobacco products during the 5 years preceding the diagnosis; and

- Must not have been employed in any other position in the 5 years preceding the diagnosis that is proven to create a higher risk for any cancer.

The cancer benefits cannot result in any cost to the firefighter. If there are any out of pocket deductible, copayment or coinsurance costs incurred by a firefighter due to cancer treatment, the new law requires “timely” reimbursement by the employer.

The cancer benefits under the new law must be made available to an eligible firefighter for 10 years after the date he or she terminates employment, as long as the firefighter:

- Continues coverage in an employer-sponsored health plan or group health insurance trust after termination of employment;

- Meets all the other eligibility criteria for an active firefighter at the time of termination of employment; and

- Is not subsequently employed as a firefighter.

Enhanced Disability and Death Benefits

Section 112.1816(3) requires that, if a firefighter participates in an employer-sponsored retirement plan, the plan must consider the firefighter to be totally and permanently disabled in the line of duty if he or she meets the plan’s definition of totally and permanently disabled due to a diagnosis of cancer or as the result of cancer treatment. If the firefighter does not participate in an employer-sponsored retirement plan, the employer must provide a disability plan that provides a benefit of at least 42% of a firefighter’s most recent annual salary for life.

Section 112.1816(4) requires that, if a firefighter participates in an employer-sponsored retirement plan, the plan must consider the firefighter to have died in the line of duty if he or she dies as the result of cancer, or as the result of cancer treatment. If the firefighter does not participate in an employer-sponsored retirement plan, the employer must provide a death benefit to the firefighter’s beneficiary equal to at least 42% of the firefighter’s most recent annual salary for at least 10 years following the firefighter’s death.

It appears that the basic eligibility requirements for cancer benefits contained in section 112.1816(2) discussed above do not apply to the disability benefits under subsection (3) or the death benefits under subsection (4). Under the new law, a firefighter is deemed to be disabled in the line-of-duty or to have died in the line-of-duty upon a diagnosis of cancer, regardless of whether the firefighter used tobacco or was employed in another position with a higher risk of cancer during the preceding 5 years. It appears that a firefighter will be eligible for the new cancer-related disability and death benefits immediately upon meeting the definition of “firefighter.”

Additionally, subsection 4(c) provides that the beneficiaries of any firefighter who dies as a result of cancer or cancer treatment are entitled to the benefits described in section 112.191(2)(a), which currently provides a one-time payment to the beneficiaries of a firefighter killed in the line of duty in the amount of $50,000 (increasing to $75,000, effective July 1, 2019 – see SB 7098, below).

Costs Associated with Firefighter Cancer Benefits to be Borne “Solely by the Employer”

SB 426 makes it clear that all costs associated with the new firefighter cancer benefits must be borne “solely by the employer.” Although current disability and death benefits under a retirement plan are funded in part with employee contributions, the new law expressly prohibits an employer from increasing employee pension contributions to fund the cancer-related disability and death benefits.

The bill increases employer contributions to the Florida Retirement System to fund disability and death benefit enhancements as follows:

- Required employer contribution for Special Risk Class will increase by 0.08%.

- Required employer contribution to pay down the unfunded liability for the Special Risk Class will increase by 0.01%.

- Required employer contribution to pay down the unfunded liability for the DROP will increase by 0.02%.

The above contribution increases are in addition to the FRS employer contribution rate increases passed by the legislature this year (see page 5 of this memo).

These additional FRS contributions are estimated to exceed $4.84 million during the first year of implementation. This estimate does not include the actuarial impact of disability and death benefit enhancements under local government retirement plans. It also does not include the increased costs associated with the guaranteed cancer treatment benefit or the $25,000 lump sum payment.

Article X, section 14 of the State Constitution, requires cities and special districts sponsoring local retirement plans to fund any increase in retirement benefits on a sound actuarial basis. Therefore, although it is not addressed in the new law, an actuarial impact study will likely be required to determine the increase in contributions necessary to fund the disability and death benefit enhancements.

Finally, SB 426 requires the Division of State Fire Marshal within the Department of Financial Services to adopt rules to establish employer cancer prevention best practices related to personal protective equipment, decontamination, fire suppression apparatus, and fire stations.

SB 7098 Death Benefits for Law Enforcement, Correctional, and Correctional Probation Officers, Firefighters and EMTs/Paramedics, and Florida Residents in the U.S. Armed Forces Killed in the Line of Duty (by Governmental Oversight and Accountability)

Section 112.19, Florida Statutes, currently provides a one-time payment to the beneficiary or beneficiaries of a law enforcement, correctional or correctional probation officer killed in the line of duty. The one-time payment is $50,000 if the officer is accidentally killed in the line of duty. An additional $50,000 must be paid if the death occurred at the scene of a traffic accident, while enforcing traffic laws or ordinances or during the officer’s response to a fresh pursuit or other emergency; and $150,000 must be paid if the death was the result of an intentional act. These amounts are adjusted annually based on the Consumer Price Index. Effective July 1, 2019, SB 7098 will increase the above amounts to $75,000, $75,000 and $225,000, respectively, and remove the annual adjustment.

SB 7098 also amends section 112.191, Florida Statutes, to apply the same changes to benefits paid to the beneficiary or beneficiaries of a firefighter killed in the line of duty. A new section 112.1912 would be created to provide the same line of duty death benefits to emergency medical technicians and paramedics. A new section 295.061 would also be created to provide the same death benefits to Florida residents on active duty in the United States Armed Forces, who are killed while engaged in the performance of official duties.

The law currently provides for a waiver of college tuition and fees for the surviving spouse and children of a police officer, corrections officer, probation officer or firefighter killed in the line of duty. SB 7098 expands the waiver to include paramedics and emergency technicians, as well as Florida National Guard members and U.S. Armed Forces members killed on active duty.

SB 7098 passed the Legislature and awaits the Governor’s signature.

SB 7016 FRS Employer Contributions (Government Oversight and Accountability)

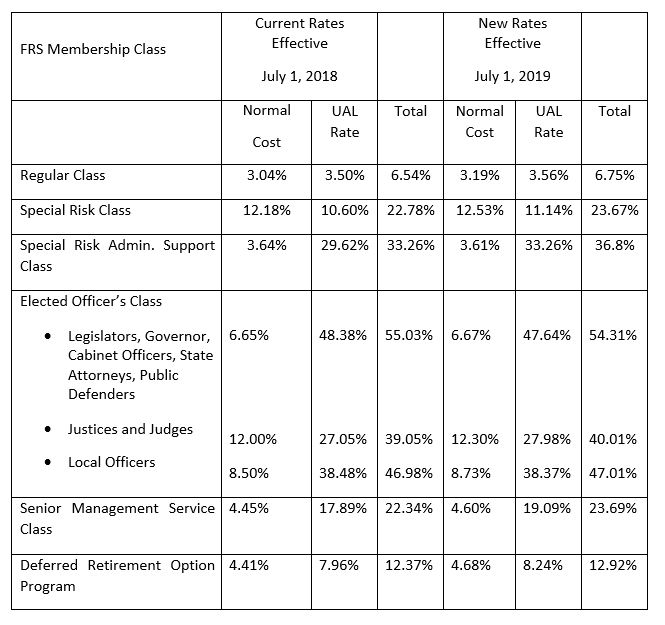

SB 7016 contains the FRS employer contribution rates for the year beginning July 1, 2019. The contribution rates are intended to fund the full normal cost as well as the amortization payment for unfunded actuarial liabilities, as reflected in the actuarial valuation for fiscal year ended June 30, 2018. The bill provides the following employer contribution rates:

Note: the above employer contribution rates do not include the FRS health insurance subsidy contribution (1.66%), which is not changed in the bill; or the 0.06% employer assessment for administrative and educational expenses. Also, the above employer contribution rates do not reflect the 3% member contribution.

SB 7016 passed and has been signed into law by the Governor.

Bills That Did Not Pass

SB 402 FRS Reemployment of School Personnel (Gruters); HB 137 (Good)

SB 402 would allow teachers who retired under the Florida Retirement System to be reemployed as substitute teachers within 6 months of retirement or deferred retirement option plan participation (DROP). The reemployed substitute teachers would not renew membership or receive additional service credit under FRS. The bill requires the Department of Management Services to obtain a Private Letter Ruling (PLR) from the Internal Revenue Service to confirm that the legislation does not violate the requirements for qualification under section 401(a) of the Internal Revenue Code.

Neither SB 402 nor HB 137 was heard in committee this year.

SB 784 FRS Cost of Living Adjustment (Gruters); HB 779 (Clemons, Willhite)

These bills would provide a minimum cost-of-living adjustment (COLA) of at least 2% for FRS members who retire on or after July 1, 2011 with service credit earned prior to July 1, 2011. Under the current FRS statute, a 3% COLA is applied to benefits earned before July 1, 2011, but no COLA is applied to benefits earned on or after that date. Thus, the member’s COLA amount is based on the quotient of the member’s service credit earned before July 1, 2011, divided by the member’s total service credit. Under SB 784, the COLA for members with FRS service before July 1, 2011 could not be less than 2%.

SB 784 was approved by Government Oversight and Accountability on April 10th, but no other action was taken on either bill.

HB 1091 Pension of Retired Deputy Scot Peterson (Roach); SB 1450 (Gruters)

These bills declare that Deputy Scot Peterson, who recently retired from the Broward County Sheriff’s Office, shall forfeit all rights & benefits under the Florida Retirement System due to “his wanton or willful neglect in performance of his assigned duties & contravention of his oath of office” in connection with his response to the 2018 mass shooting incident at Marjory Stoneman Douglas High School. No action was taken on either bill.

SB 1096 FRS Reemployment after Retirement (Perry); HB 631 (Watson)

Under current law, an FRS member who retired or ended DROP participation before July 1, 2010 may be reemployed by an FRS employer if the reemployment occurs at least one calendar month after retirement. However, the member may not receive both a salary and retirement benefits for 12 months after retirement. If a member is reemployed while receiving retirement benefits the member must notify the employer and FRS, and benefits are suspended until the 12-month period concludes. Under SB 1096, a member could have been reemployed by an employer participating in the FRS before completion of the 12-month limitation period if the retiree was employed on a part-time basis and was not qualified to receive retirement benefits during the 12-month period after the date of reemployment.

Neither SB 1096 nor HB 631 was heard in committee this year.

SB 1190: FRS Special Risk (Montford); SB 574 (Diaz); HB 803 (Aloupis)

This bill would extend membership in the FRS Special Risk Class to employees of Florida State Hospital, Sunland Center, or North Florida Evaluation and Treatment Center, who spend at least 65% of their time performing duties that involve contact with patients or inmates. Benefits would be calculated using the Special Risk multiplier (3.0%).

A committee substitute for SB 574 was approved by Committee on Governmental Oversight and Accountability.

Neither HB 803 nor SB 1190 was placed on a committee agenda.

HB 511 Special Risk Class 911 Operators (Willhite); SB 744 (Book)

This bill would extend membership in the FRS Special Risk Class to FRS members employed as 911 public safety telecommunicators. Monthly benefits for 911 telecommunicator members would still be calculated using the Regular Class multiplier (1.6%).

Neither HB 511 nor SB 744 was heard in committee this year.

If you have any questions on a retirement-related bill, please let us know.

LLW Participated in the St. Petersburg Bar Association’s Health & Wellness Challenge

LLW’s St. Petersburg office participated in the St. Petersburg Bar Association’s Health & Wellness Challenge during the month of May. The overall goal of the Challenge was to encourage a workplace environment that supports overall staff wellness. As a part of the initiative, LLW’s St. Petersburg office committed to 3 hours of dedicated wellness time every week, held “walking meetings” and enjoyed healthy lunches. For more details about this initiative, visit https://www.stpetebar.com/page/Wellness.

Summer Conferences and Presentations

Meghan Hennessy has joined LLW’s St. Petersburg office as a Law Clerk. Meghan previously served as an Associate Attorney at a law firm in Houston, Texas where she focused on civil litigation, and as a Law Clerk with the Orange County California District Attorney’s Office. Meghan previously served as a Summer Associate at LLW in 2016. Meghan received her law degree from the University of Texas School of Law and received her Bachelor of Arts degree in Political Science, Government and Psychology from Florida State University.

LLW attorneys Janice Rustin and Glenn Thomas presented “Emerging Issues in Pension Law” at the Florida Public Human Resources Association Conference July 22nd in Bonita Springs.

LLW attorneys participated in the Florida Chamber’s 33rd Annual Environmental Permitting Summer School July 16-19th in Marco Island. LLW is proud to be a long-time supporter of the event and host its annual networking event on-site. Click here to view photos from the event and click here to view the list of nine LLW attorneys that presented at the conference this year.

LLW attorneys attended the Florida Municipal Attorneys Association Annual Conference July 11-13th in Palm Beach.

Fred Aschauer presented “Agency Deference – A New Standard” at the Florida Bar’s Annual Convention June 28th in Boca Raton.

LLW attorney Robert Williams attended the Florida Nursery, Growers and Landscape Association Annual Convention June 21-22nd in Tampa.

Brenna Durden attended the Leadership Florida Annual Meeting June 20-23rd in Orlando.

Glenn Thomas and Janice Rustin participated in a Legislative Workshop to discuss implementation of the new Firefighter Cancer Bill (SB 426) hosted by Gehring Group, June 17th in Palm Beach Gardens.

Robert Williams attended the Florida Cattlemen’s Association Annual Convention June 17-20th at Marco Island.

Robert Williams attended the Key Environmental Issues in U.S. Environmental Protection Agency Region 4 Conference June 11th in Atlanta.

LLW sponsored the Florida Association of Special Districts Annual Conference June 10-13th in Fort Myers. LLW attorneys Terry Lewis, Chris Lyon, Natalie Kato and Glenn Thomas presented at the conference.

LLW hosted a Riparian Rights lunch & learn on June 6th. Guests attended at any of the four LLW offices or remotely via Webex. A follow-up lunch & learn will take place this fall, if you are interested in participating, please contact Tyler Byrd at tbyrd@llw-law.com.

LLW is sponsored the Jacksonville Women Lawyers Association Annual Judicial Reception on June 5th.

LLW sponsored the 45th Annual Equal Opportunity Day Gala May 31st in West Palm Beach.

LLW attorneys attended the Manatee County 2019 Local Government Law Seminar May 23rd in Palmetto.

LLW attorneys attended the B3 Bash May 23rd in Tallahassee. The event benefitted Independence Landing, a not-for-profit residential community for adults with a range of intellectual and/or cognitive disabilities.

LLW was the presenting sponsor of the 2019 Coastal Environment Seminar May 21st in Tierra Verde, hosted by Leadership St. Pete.

LLW sponsored the Palm Beach County League of Cities Installation Luncheon May 22nd in West Palm Beach. LLW attorneys Bill Capko, Alfred Malefatto, Janice Rustin and Telsula Morgan attended the event.

LLW attorneys participated in the Port Manatee Propeller Club 15th Annual Golf Classic May 17th in Parrish.

LLW attorney Kathryn Rossmell served as a panelist at the Nonprofit Chamber for Health and Human Services Meeting May 16th in Lake Worth. The meeting highlighted a small group of local business leaders who were asked to discuss their philanthropic goals and expectations in their nonprofit relationships. Ms. Rossmell was invited to be a panelist due to LLW’s long-standing firm core value of philanthropic giving, volunteering and community outreach. Other panelists represented Keller Williams Realty, IBM Southeast Credit Union and Marsh McLennan Insurance. For more information, visit https://www.nonprofitchamberpbc.org/.

LLW sponsored the Chamber of Commerce of the Palm Beaches Women for Women 5k/10k Road Race May 11th in Lake Worth. Proceeds from the race support the Jupiter Medical Center Margaret W. Niedland Breast Center.

LLW sponsored the Moments Luncheon May 10th in Palm Beach Gardens. Proceeds from the Moments Luncheon support Healthy Mothers Healthy Babies of Palm Beach County. LLW attorney Tara Duhy is the Immediate Past Chair of HMHB and Kathryn Rossmell served on the Planning Committee for the luncheon.

Fred Aschauer and John Wallace attended the Spring Florida EHS Roundtable May 9th in Lakeland. LLW was a proud sponsor.

LLW’s West Palm Beach office participated in the Community Denim Day April 29th in recognition of Child Abuse Prevention Month. Funds raised from the community effort support Families First of Palm Beach County, an organization that has been providing services to successfully prevent child abuse for over 28 years.

Brenna Durden, Wayne Flowers and John Wallace attended the JAXPORT Logistics and Intermodal Conference April 29th in Ponte Vedra Beach.

LLW sponsored the Annual Purple Craze event April 27th in Tallahassee. Proceeds from the event support the Alzheimer’s Project.

LLW sponsored the 19th Annual Nicholas Megrath Scholarship Dinner and Awards Event April 25th in West Palm Beach. Julia Jennison, President of the Friends of the Gale Academy of Environmental Science and Technology, awarded thousands of dollars of scholarships to students during the event. Alfred Malefatto, Scholarship Chair of the Academy, served as the MC for the event. All proceeds benefited students of the Academy. Click here for more information.